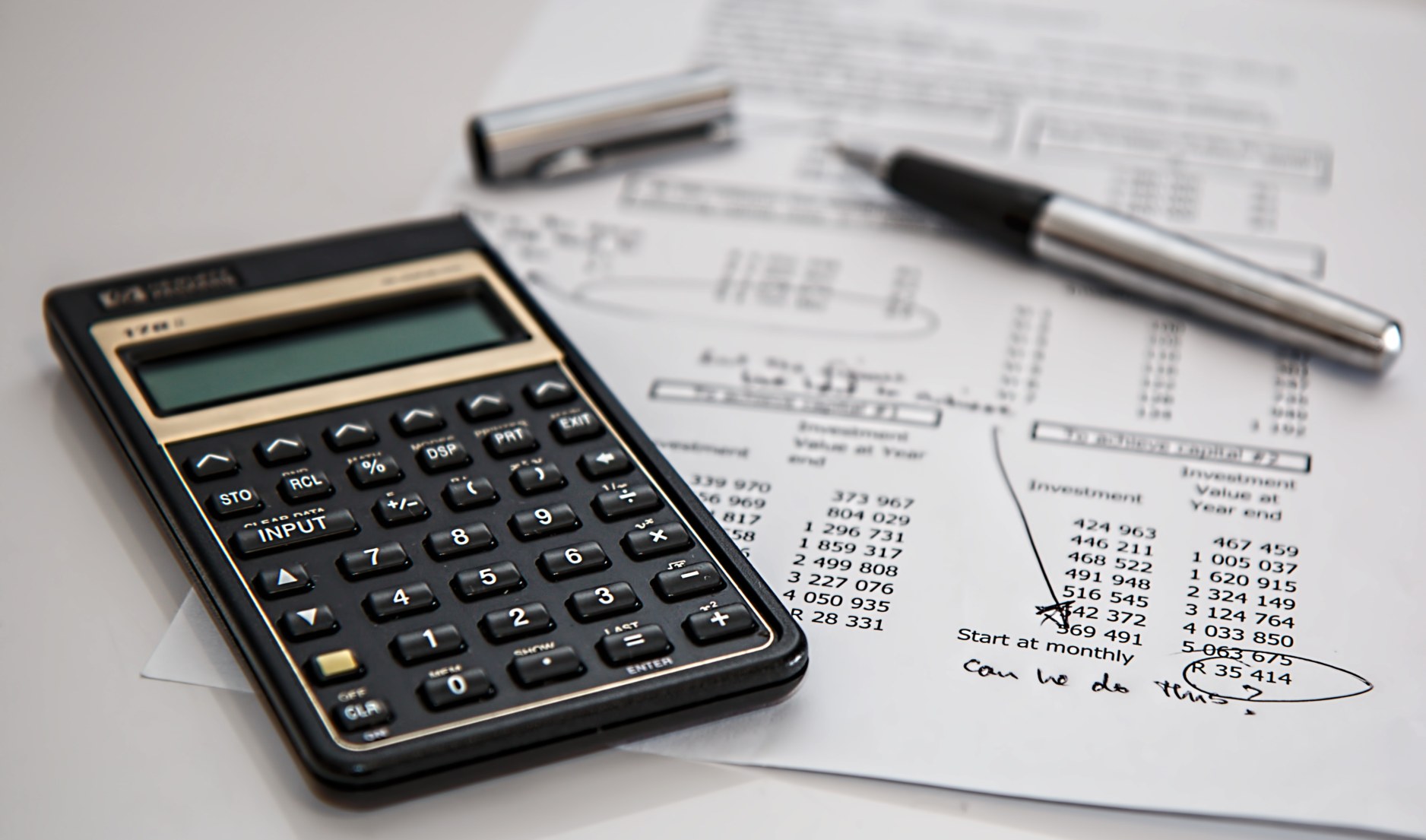

As the year comes to a close, it’s time for HOAs and condo owners to take a closer look at financial statements and prepare for the upcoming year’s budget. Not only does a thorough financial review ensure that the community remains financially stable, but it also helps address any potential challenges or shortfalls before they escalate. Moreover, understanding how HOA funds are allocated allows condo owners to build trust with the board and contribute to informed decision-making. This guide walks condo owners through the key elements of an HOA’s year-end financial review while offering practical advice for understanding budgets and planning ahead.

Why a Year-End Financial Review Is Important

1. Transparency and Accountability

Year-end financial reviews provide a transparent account of how HOA funds were spent throughout the year. Condo owners understand where their dues are allocated and how responsibly the HOA board has managed community finances.

2. Identifying Surpluses or Shortfalls

By reviewing financial statements, HOAs can identify whether the community has a surplus that can be reinvested or a shortfall that requires adjustments in the upcoming year’s budget.

3. Planning for Long-Term Needs

A detailed financial review ensures that the community is adequately saving for long-term projects, such as roof replacements, landscaping upgrades, or infrastructure repairs.

Key Elements of the Year-End Financial Review

1. Operating Budget vs. Actual Spending

Compare the planned budget for the year against actual expenses. Look for variances and determine if overspending occurred and why.

- Savings Opportunities: Identify areas where the HOA came under budget to assess potential cost-saving measures.

- Overspending: Investigate whether unplanned maintenance, higher utility costs, or other unexpected expenses caused a deficit.

2. Reserve Fund Analysis

The reserve fund is essential for covering major repairs and unexpected emergencies. A year-end review should include:

- Future Contributions: Evaluate whether the HOA’s annual contributions to the reserve fund are sufficient to cover anticipated expenses.

- Adequacy Check: Ensure that reserve fund levels meet state requirements or community needs.

3. Delinquent Dues

Review the status of unpaid dues and determine how delinquencies are affecting the community’s financial health. Consider implementing or revising collection policies to minimize overdue accounts.

4. Vendor Contracts and Expenses

Examine vendor invoices to ensure services were delivered as agreed. Assess whether any contracts need to be renegotiated for better terms in the upcoming year.

How Condo Owners Can Get Involved

1. Attend HOA Meetings

Year-end financial reviews are typically discussed in HOA board meetings. Attend these sessions to stay informed and ask questions about spending, budget plans, and reserves.

2. Request Financial Statements

Condo owners have a right to review financial documents, including:

- Profit and loss statements

- Balance sheets

- Reserve fund reports

3. Advocate for Transparency

If you notice discrepancies or have concerns, communicate with the board to request clarification or propose solutions. Transparency ensures trust between the board and condo owners.

4. Participate in Budget Planning

Some HOAs invite residents to provide input on the upcoming year’s budget. Use this opportunity to suggest priorities, such as better landscaping or upgraded amenities, while staying mindful of costs.

Preparing for the Upcoming Year’s Budget

1. Anticipate Rising Costs

Account for inflation and expected increases in costs, such as utilities, insurance, and vendor fees.

2. Plan for Capital Improvements

Evaluate whether any significant repairs or upgrades, like roof replacements or parking lot resurfacing, will be required next year.

3. Adjust Dues if Necessary

If the community faced a shortfall or needs to increase its reserve fund contributions, HOA boards may propose raising dues. Condo owners should review the justification for any increases and ensure they are reasonable.

4. Explore Cost-Saving Strategies

Propose initiatives such as energy-efficient upgrades or renegotiating vendor contracts to help manage expenses without compromising services.

Red Flags to Watch For

Recurring Delinquencies: Persistent unpaid dues may indicate a need for stronger collection policies.

Inadequate Reserve Funds: Low reserves can lead to special assessments, which burden condo owners unexpectedly.

Unexplained Variances: Significant differences between budgeted and actual expenses with no clear explanation can signal poor financial management.

A thorough year-end financial review is essential for maintaining the financial health of an HOA community. By carefully examining financial statements, assessing reserve funds, and preparing for the next year’s budget, both condo owners and HOA boards can work together to ensure transparency, stability, and long-term success. Furthermore, staying engaged and informed enables condo owners to address potential concerns early and suggest meaningful improvements. In the end, a well-managed financial review not only fosters trust but also lays the groundwork for a thriving community in the coming year.