The Florida condo market underwent significant changes in 2024, shaped by shifts in buyer preferences, new regulations, and broader economic factors. Whether you’re an investor or a homeowner, understanding these trends and their implications for 2025 is crucial for making informed decisions. Here’s a detailed analysis of the market’s current state and what lies ahead.

Key Market Trends in 2024

The 2024 Florida condo market was marked by contrasting dynamics, including rising inventory and adjusted pricing:

Sales and Inventory Dynamics:

Sales of existing condos and townhouses in Florida decreased by 20.7% in September 2024 compared to the same period in 2023.

Conversely, inventory levels surged, with a 91.9% rise in condo and townhouse listings during the second quarter of 2024.

Pricing Adjustments:

The median sale price for condos dipped by 3.4% to $314,000 in September 2024. This reflects a market recalibrating due to increased inventory and cautious demand.

Regulatory Impacts:

Stricter safety regulations following the 2021 Champlain Towers South tragedy introduced higher maintenance costs and HOA fees. These changes have prompted some owners to sell, further boosting inventory levels.

Predictions for 2025

Despite the challenges of 2024, the Florida condo market is expected to stabilize and even present opportunities in 2025:

Market Stabilization:

Experts predict a more balanced market, with modest price increases in some regions and slight declines in others. This could create a level playing field for buyers and sellers.

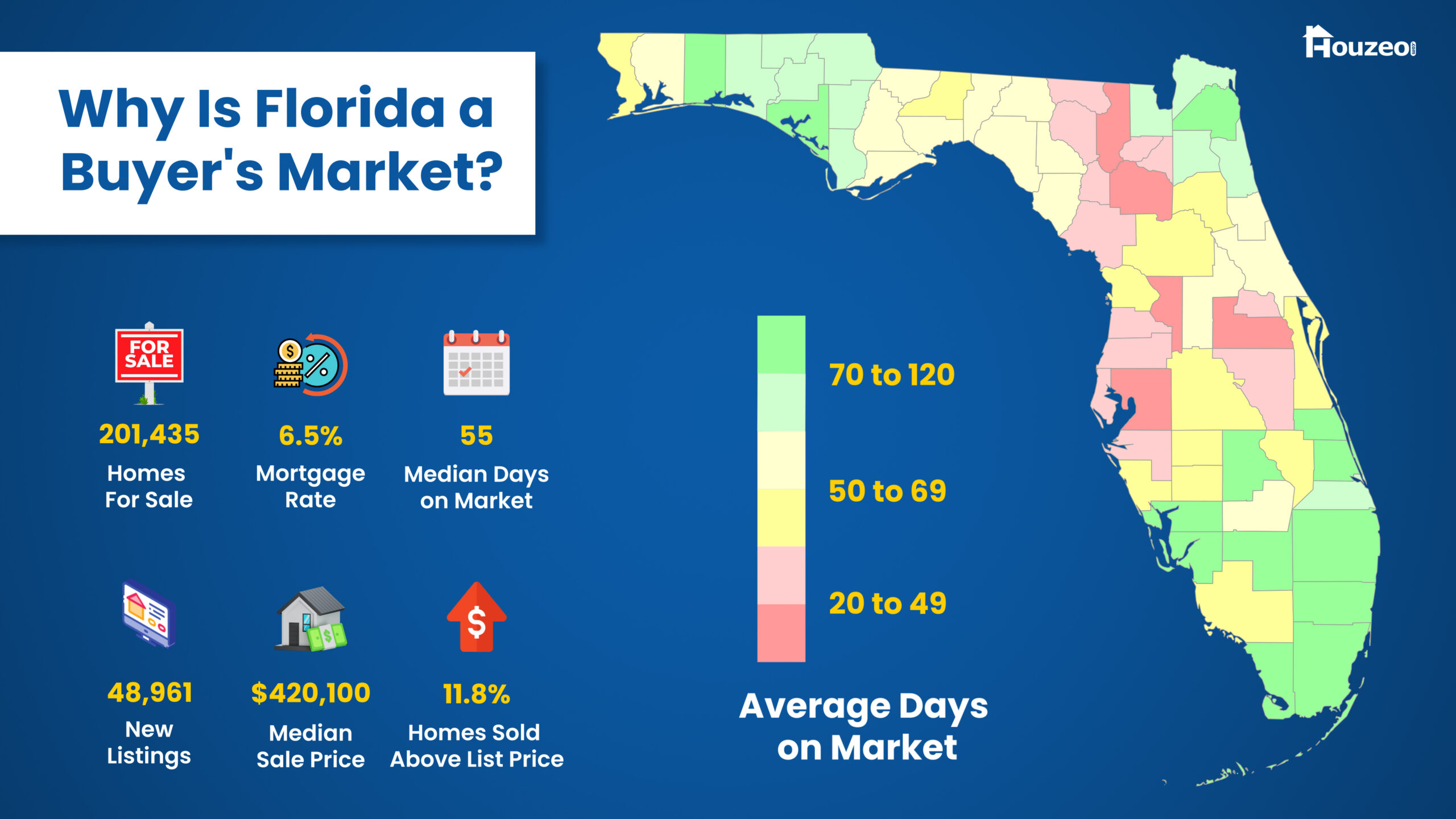

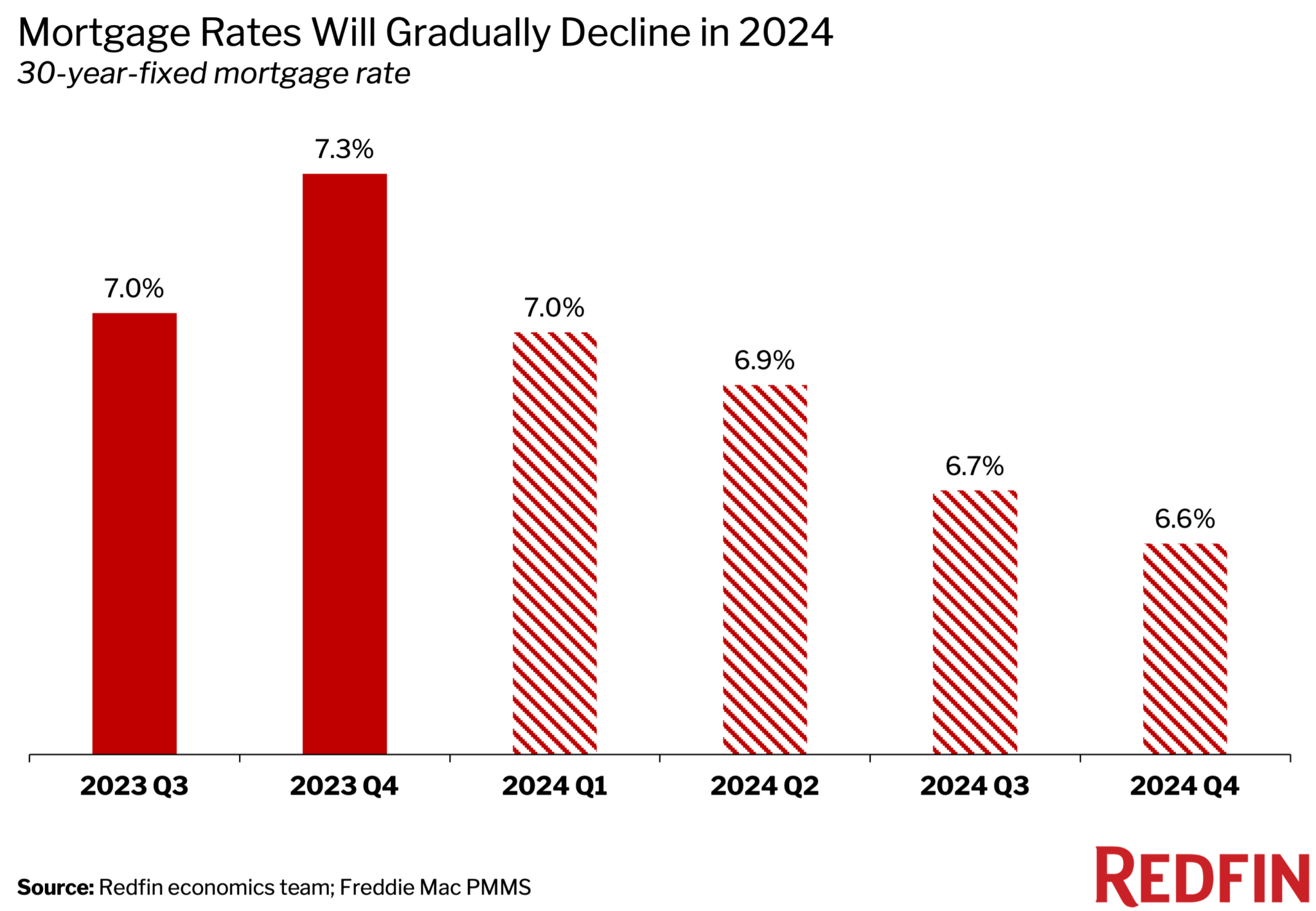

Interest Rate Influence:

Mortgage rates are projected to decline to around 4.0% by late 2025, potentially improving affordability and driving demand.

Shifts in Investor Activity:

Institutional investors are scaling back, reducing competition, and opening the market for individual buyers and smaller investors.

Key Considerations for Investors

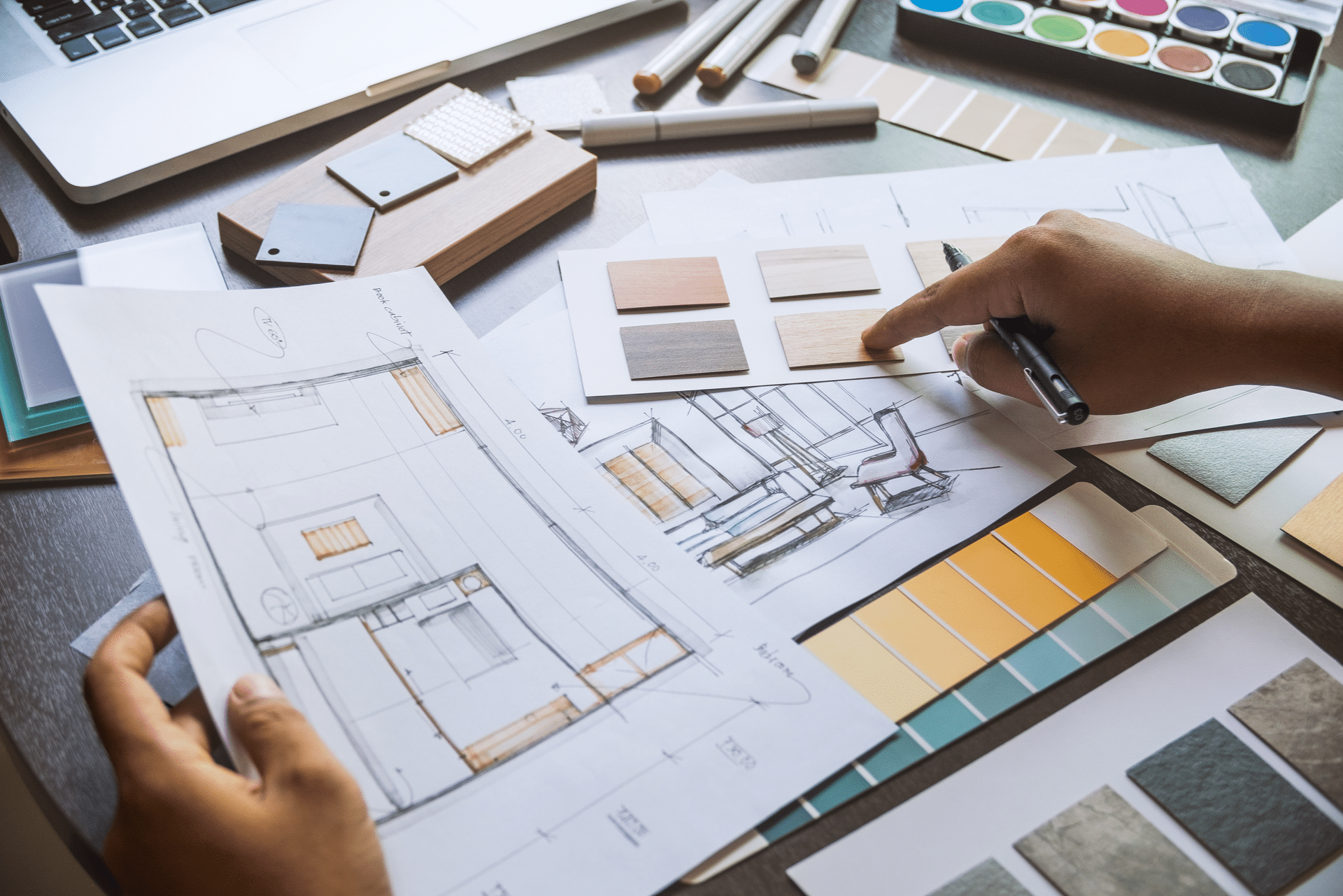

As the market evolves, strategic planning is essential for investors aiming to maximize returns:

Evaluate Building Health and Association Finances:

Regulatory changes mean higher costs for older buildings. Perform due diligence to assess the financial health of condo associations and the state of the property.

Focus on Regional Insights:

Trends vary across Florida, with areas like Miami seeing unique dynamics compared to smaller coastal towns. Tailor your strategy to local conditions.

Adopt a Long-Term View:

Florida’s popularity as a destination, favorable tax policies, and steady population growth point to a promising long-term outlook for condo investments.

The Florida condo market in 2024 reflected a period of adjustment, influenced by increased inventory, pricing shifts, and regulatory impacts. However, the outlook for 2025 offers optimism with anticipated market stabilization, lower interest rates, and emerging opportunities for savvy investors. By staying informed and conducting thorough due diligence, investors can navigate these changes and capitalize on Florida’s enduring appeal as a real estate destination.