The South Florida condominium market is facing a critical moment as investor interest in short-term rentals (STRs) continues to grow while new regulatory challenges and economic pressures reshape condominium policies. From the impact of the Champlain Towers collapse to post-COVID flexibility and evolving market dynamics, these trends are fundamentally influencing how condominium associations approach STR policies. Let’s dive deeper into the factors shaping this evolving landscape.

Post-COVID Flexibility: A Driver for STR Investment

Post-COVID, the short-term rental market has grown substantially due to shifts in work and travel patterns. The rise of remote work and the flexibility it offers have led to increased demand for short-term accommodations, especially in prime vacation spots like South Florida. Investors, looking to capitalize on this trend, are focusing on properties that allow short-term leasing. STR properties in Miami, Fort Lauderdale, and the surrounding regions are appealing because they offer investors higher returns than traditional long-term rentals.

High demand has pushed up property prices in areas with more lenient STR policies. However, this surge is also causing friction among long-term residents in these condominiums, who are concerned about the constant turnover of renters and its impact on community cohesion and property maintenance.

Regulatory Challenges: Post-Surfside Reforms

The Champlain Towers South collapse in 2021 profoundly affected condominium regulations. New state laws now mandate stricter safety inspections, reserve studies, and structural integrity assessments for aging buildings. Older condos, in particular, are facing high costs to comply with these regulations, driving a wave of unit sales and adding significant inventory to the market.

Condominium associations are required to maintain adequate reserves for repairs and maintenance, driving up monthly fees for owners. This has led many owners to sell their units, especially in buildings requiring significant upgrades. Additionally, special assessments have become more common, further straining the financial situation for middle- and lower-income condo owners.

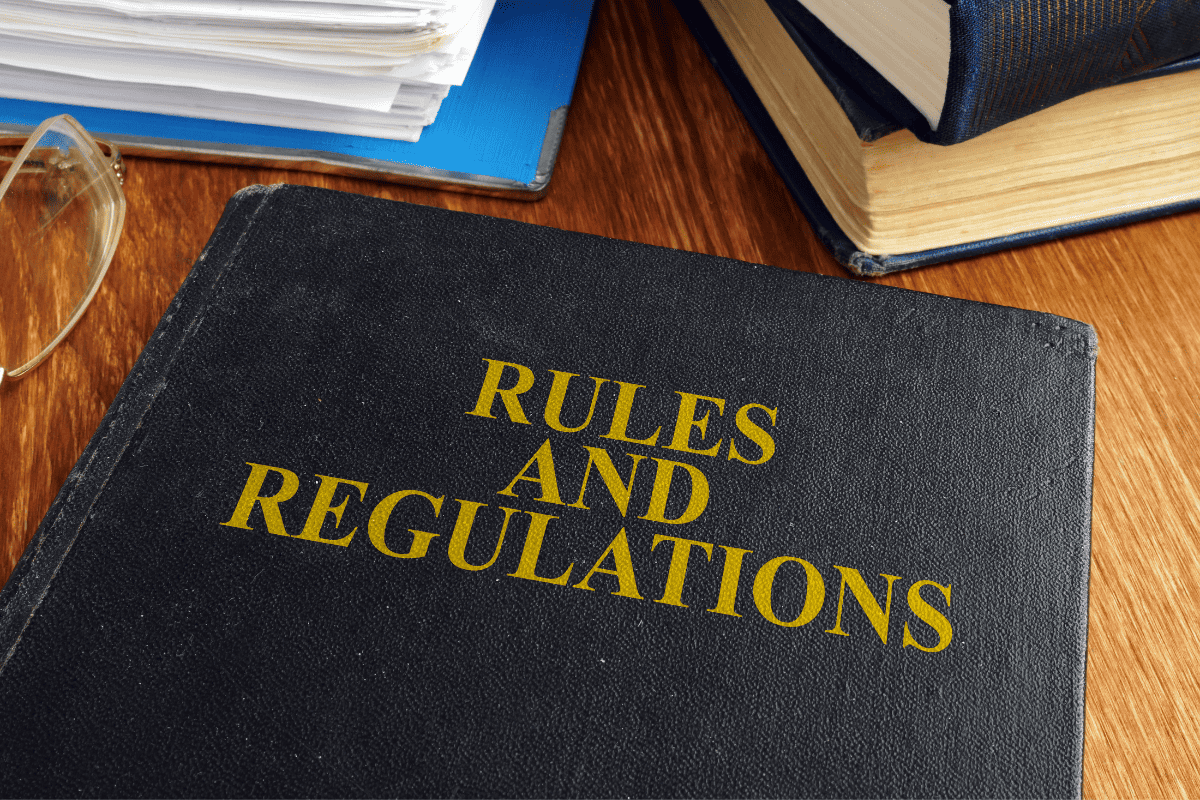

These rising costs are exacerbating tensions between condominium associations and STR investors. Associations are now considering tighter restrictions on STRs to balance financial needs with maintaining property values and the well-being of long-term residents.

The Rise of Investor-Driven Condo Sales

As financial pressures mount on owners of older condominium units, many are opting for bulk sales to developers. These bulk buyouts allow developers to acquire multiple units, terminate the condominium association, and redevelop the property. This trend is particularly noticeable in aging buildings, where maintenance costs and regulatory compliance make continued ownership untenable. For developers, these buyouts present opportunities to create new, modern residential or mixed-use projects.

At the same time, the influx of investor demand for STR-friendly properties has led to a more competitive market. Many investors are now seeking condominiums that permit STRs as a way to maximize rental income, but they face growing resistance from condominium associations and regulatory bodies aiming to protect long-term residents.

Insurance and Rising Costs: Impact on STRs

One of the often-overlooked aspects of the STR market is the rising cost of insurance for condominium buildings that permit short-term rentals. Insurers often view STR properties as higher risk due to frequent turnover and increased wear and tear. As a result, many condominium associations face higher premiums or stricter insurance requirements, which can make STRs financially unviable for some investors.

The increased costs associated with insurance, combined with the regulatory requirements imposed post-surfside, are forcing many condominium associations to reconsider their STR policies. Some associations are limiting the number of days units can be rented out or restricting STRs to certain areas within the building.

Balancing Investor Interests and Community Well-being

As South Florida continues to attract investors eager to tap into the STR market, condominium associations are tasked with balancing these demands against the needs of long-term residents. While STRs offer financial benefits, they also pose challenges in maintaining community standards and building upkeep. Associations must navigate a complex landscape of regulations, economic pressures, and resident concerns to create policies that serve investors and permanent residents.

The South Florida condominium market is at a crossroads. Post-COVID flexibility, investor demand for STR properties, and new regulatory requirements are all reshaping the landscape. As condominium associations adapt to these changes, balancing the interests of investors and long-term residents will be key to maintaining stability and preserving property values in the years ahead.