As we step into 2025, Homeowners Associations (HOAs) face evolving financial challenges and opportunities. Effective budgeting is essential to maintain community amenities, uphold property values, and ensure fiscal responsibility. This guide offers practical advice for HOA boards and property owners to navigate the financial landscape of the coming year successfully.

1. Review Past Financial Performance

Begin by analyzing your HOA’s financial performance over the past few years. Identify income and expenditure trends, areas of overspending or underspending, and assess reserve fund usage. This retrospective analysis provides insights into your association’s financial health and highlights areas for improvement.

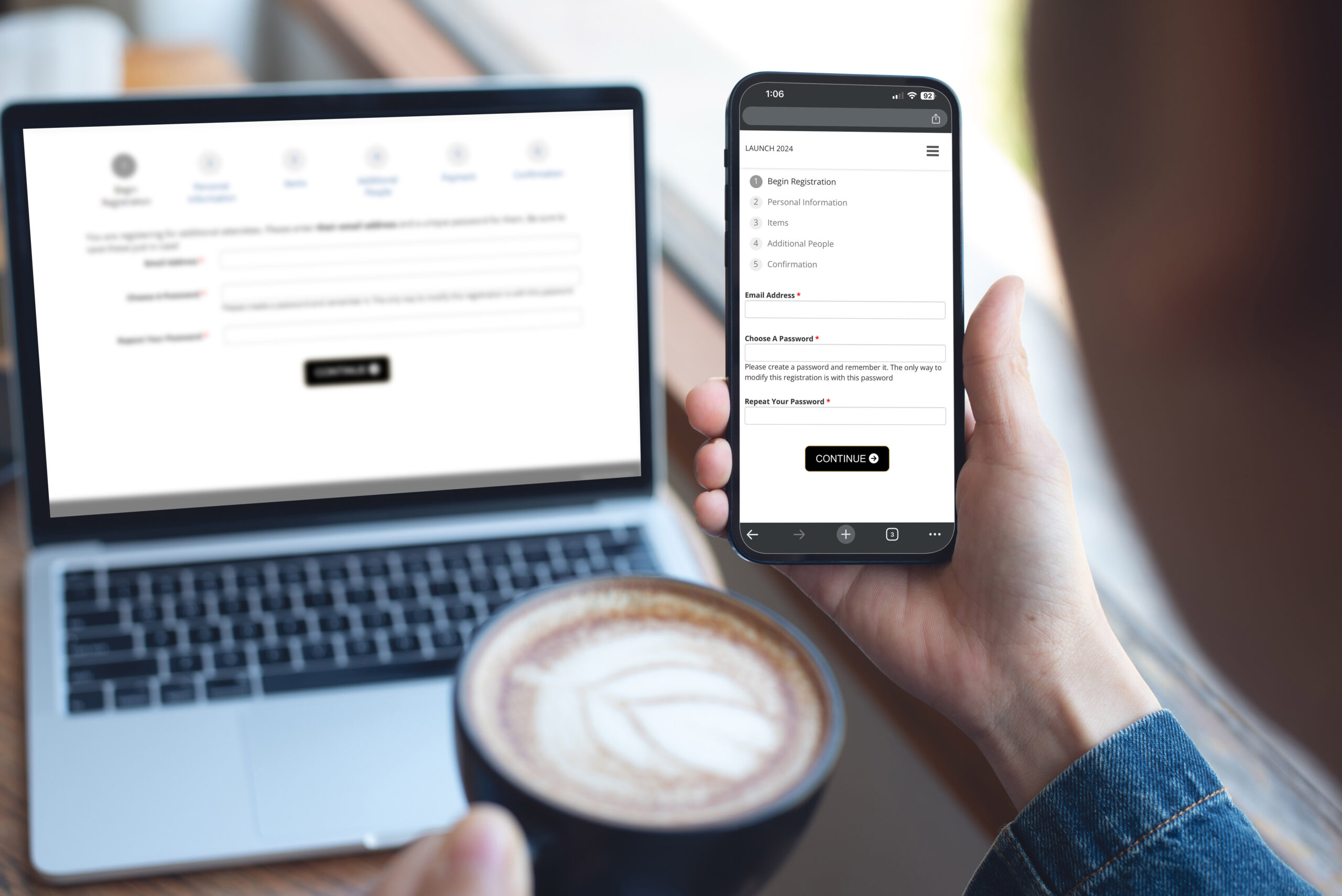

2. Establish a Clear Budget Timeline

Setting a structured timeline for the budgeting process ensures thorough planning and timely execution. Consider the following steps:

- Initial Financial Review: Assess the previous year’s financial statements and performance.

- Gather Input: Collect suggestions and feedback from board members and homeowners.

- Draft the Budget: Prepare a preliminary budget using financial tools or spreadsheets.

- Board Review and Revision: Present the draft to the board for discussion and adjustments.

- Community Approval: Share the proposed budget with the community for approval, if required.

- Implementation and Monitoring: Once approved, implement the budget and monitor expenditures regularly.

Adhering to a timeline promotes transparency and accountability within the community.

3. Accurately Forecast Expenses

Develop a comprehensive list of anticipated expenses, categorized as follows:

- Fixed Expenses: Regular, predictable costs such as insurance premiums, staff salaries, and subscription services.

- Variable Expenses: Costs that fluctuate based on usage or unforeseen events, including utilities, landscaping, and maintenance.

- Reserve Fund Contributions: Allocations for long-term maintenance and unexpected repairs.

Accurate forecasting ensures the association can meet its financial obligations without imposing unexpected assessments on homeowners.

4. Strengthen the Reserve Fund

A well-funded reserve is crucial for addressing major repairs and emergencies. To bolster your reserve fund:

- Conduct a Reserve Study: Evaluate the adequacy of current savings and identify future capital expenditure needs.

- Regular Contributions: Allocate a portion of monthly dues specifically to the reserve fund.

- Prioritize Funding: Ensure reserve contributions are prioritized over non-essential expenditures.

Maintaining a healthy reserve fund minimizes the need for special assessments and enhances financial stability.

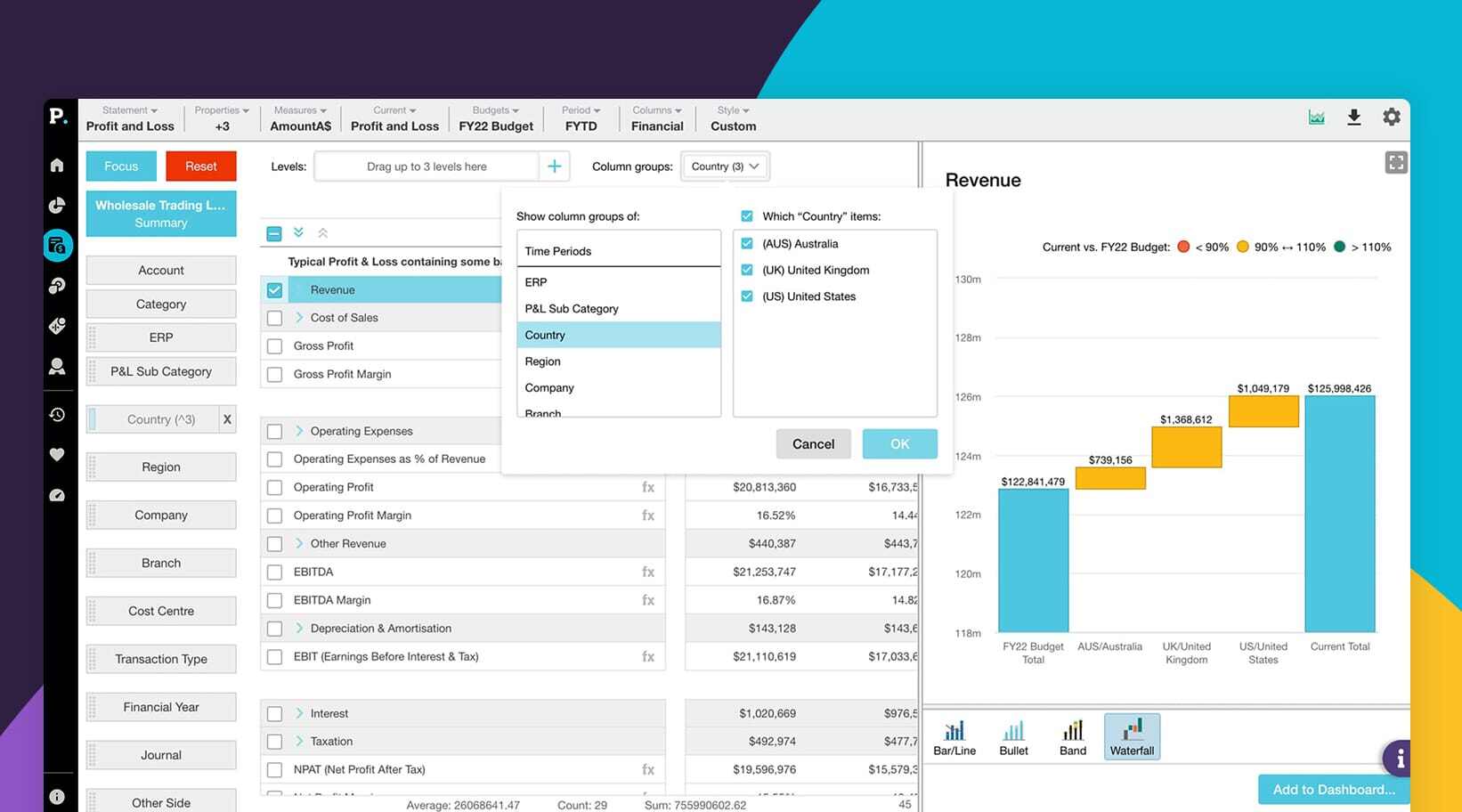

5. Leverage Technology for Financial Management

Utilizing modern financial management tools can streamline budgeting and enhance accuracy. Consider implementing:

- Budgeting Software: Tools that assist in organizing expenses, forecasting costs, and tracking financial performance.

- Automated Invoicing: Systems that manage dues collection and track payments efficiently.

- Real-Time Expense Tracking: Applications that provide up-to-date insights into spending patterns.

Embracing technology simplifies financial management and promotes transparency.

6. Communicate Transparently with Homeowners

Open communication fosters trust and encourages community involvement. To maintain transparency:

- Regular Updates: Provide homeowners with regular financial reports and budget summaries.

- Accessible Information: Ensure financial documents are easily accessible to all members.

- Feedback Channels: Create avenues for homeowners to ask questions and provide input on financial matters.

Transparent communication helps prevent misunderstandings and promotes a sense of shared responsibility.

7. Plan for Long-Term Financial Health

Beyond annual budgeting, consider the long-term financial trajectory of the association:

- Multi-Year Financial Plans: Develop 3- to 5-year financial plans to anticipate future projects and expenses.

- Regular Financial Reviews: Periodically assess financial strategies and adjust as necessary to align with changing circumstances.

- Investment Strategies: Explore safe investment options to grow reserve funds responsibly.

Proactive long-term planning ensures the association remains financially resilient and prepared for future needs.

Effective budgeting is the cornerstone of a thriving HOA community. By reviewing past performances, setting clear timelines, accurately forecasting expenses, strengthening reserves, leveraging technology, communicating transparently, and planning for the long term, HOA boards and property owners can ensure financial stability and community prosperity in 2025 and beyond.