If you own a home in a community with a homeowners’ association (HOA), you’ve likely seen the term “assessment” show up on your bills. But what exactly does it mean, and why does it sometimes increase? Whether it’s a standard monthly due or a surprise special assessment, understanding the ins and outs of HOA assessments is essential for protecting your budget—and your peace of mind.

In this blog, we’ll break down how assessments are calculated, what they pay for, and how you, as a homeowner, can get involved in the financial planning process to avoid surprises and contribute to a well-managed, financially sound community.

What Are HOA Assessments?

HOA assessments are fees collected from homeowners to fund the shared expenses of maintaining the community. These are not optional—they’re legally required and governed by your association’s Declaration of Covenants, Conditions, and Restrictions (CC&Rs).

Common Expenses Covered by Assessments:

- Landscaping, irrigation, and common area maintenance

- Pool, gym, clubhouse, or security system upkeep

- Insurance for common areas and community structures

- Management company fees

- Reserve contributions for future repairs

Regular assessments are typically paid monthly, quarterly, or annually and are set based on the association’s approved annual budget.

How Are HOA Assessments Determined?

Assessment amounts are based on the HOA’s projected expenses for the year and the number of units in the community.

The Process Generally Includes:

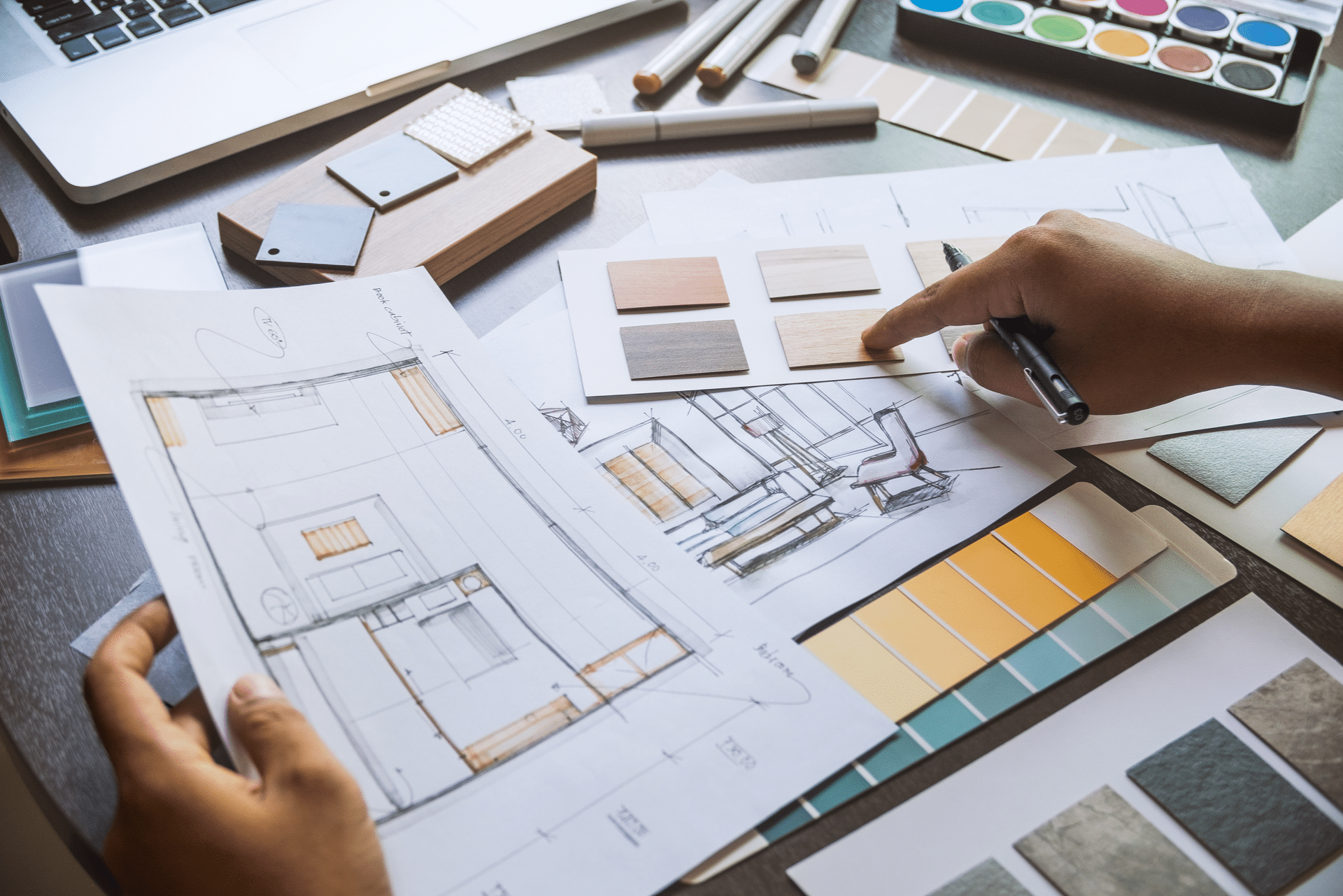

Budget Planning: The board of directors (often with help from a management company) drafts an annual budget that outlines all anticipated expenses.

Reserve Study Review: Associations must periodically review long-term maintenance needs (like roof replacements or repaving roads) to ensure they have enough reserve funds.

Assessment Allocation: The total budget is divided among homeowners, typically based on unit size, location, or evenly split.

Special Assessments:

These are one-time fees charged when unexpected costs arise—like major repairs after a storm or a legal settlement not covered in the reserves. They can range from a few hundred to thousands of dollars, so it’s critical to understand how and why they’re issued.

Tips for Homeowners to Engage in Financial Planning

Staying informed doesn’t mean becoming an accountant—but knowing the basics goes a long way in preventing financial stress.

✔️ 1. Read the Governing Documents

Your HOA’s CC&Rs and bylaws explain how assessments are set and what your rights are. This should be your first stop if you have questions.

be your first stop if you have questions.

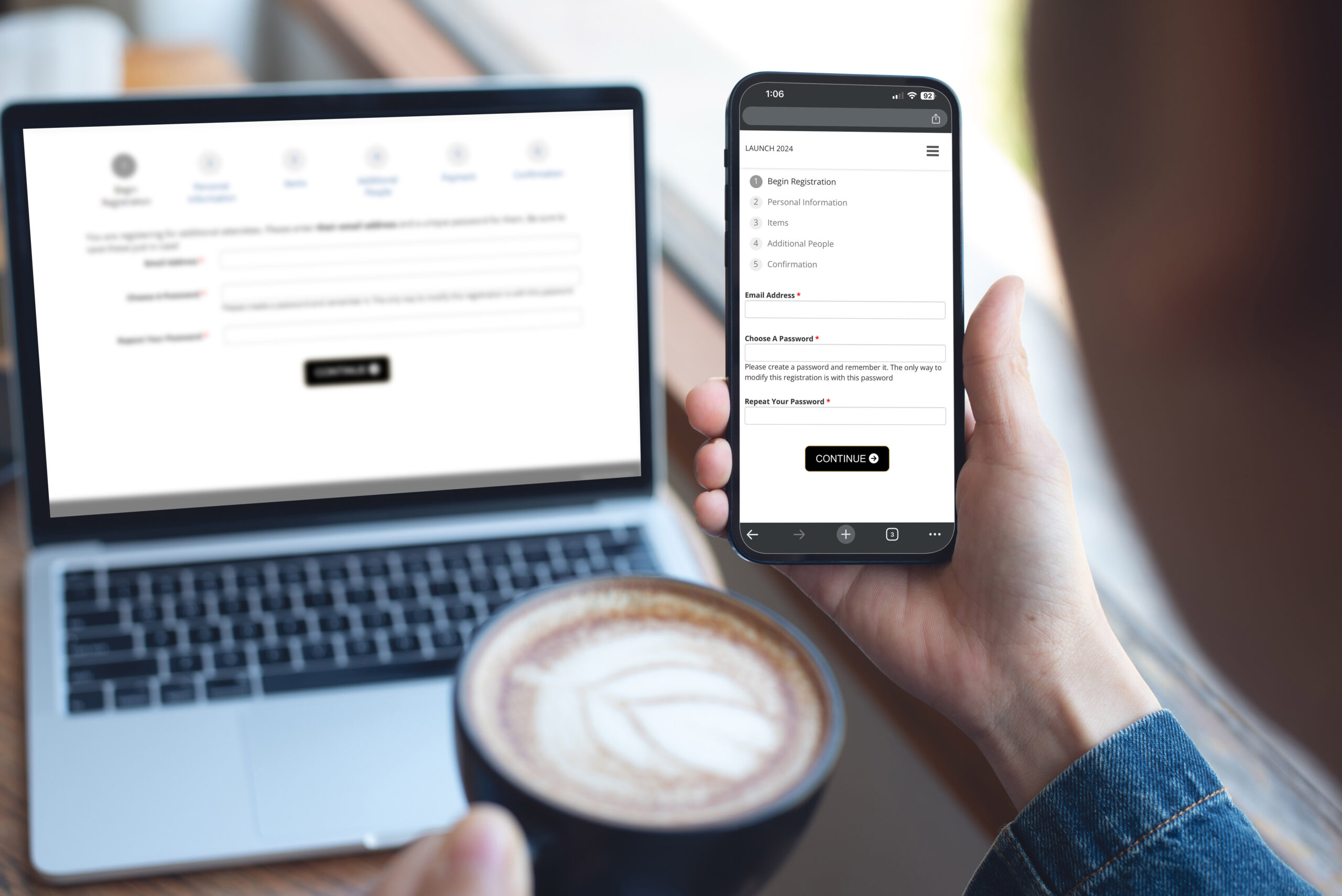

✔️ 2. Attend Budget Meetings

Most HOAs are required to hold annual budget meetings. Attend these to get clarity on how your dues are being used and voice your concerns or suggestions.

✔️ 3. Review Financial Reports Regularly

Ask for quarterly or annual financial statements. These give insight into spending, reserve balances, and whether your HOA is living within its means.

✔️ 4. Ask About the Reserve Fund

An underfunded reserve is a red flag. If the HOA isn’t saving for long-term capital repairs, homeowners are at greater risk for unexpected special assessments.

✔️ 5. Advocate for Transparency

Encourage your board to publish easy-to-read financial summaries, FAQs on assessments, or even short videos breaking down budget decisions.

✔️ 6. Budget for the Unexpected

Even in well-managed communities, unexpected assessments can happen. Setting aside a monthly “HOA emergency fund” can protect your personal finances.

Why Assessments Matter for Property Value

While nobody enjoys paying fees, consistent and well-planned assessments are a sign of a healthy community. Underfunded or mismanaged HOAs often face deferred maintenance, legal trouble, or declining property values. On the flip side, a well-funded and transparent HOA can:

- Support long-term appreciation of property values

- Attract buyers looking for stability

- Keep shared spaces pristine

- Prevent special assessments through proactive planning

Navigating HOA assessments doesn’t have to be intimidating. By understanding how they’re calculated, what they fund, and how to get involved in your community’s financial decisions, you can protect your investment and foster a more transparent and collaborative HOA.

After all, a well-informed homeowner is a powerful asset to any association.