The vacation rental industry is undergoing significant transformation in 2025. With shifting traveler preferences, evolving regulations, and technological advancements, investors must stay informed to capitalize on new opportunities. This guide provides a comprehensive overview of the current market dynamics and strategic considerations for investing in vacation rentals this year.

1. Embracing Alternative Accommodation Types

Travelers are increasingly seeking unique and personalized experiences, leading to a rise in alternative accommodations.

Tiny Homes and Modular Units: Compact living spaces offer cost-effective investment opportunities and appeal to minimalist travelers.

Glamping Sites: Luxury camping experiences, such as yurts and safari tents, cater to those seeking comfort in natural settings.

Eco-Lodges: Environmentally conscious travelers are drawn to accommodations that prioritize sustainability and immersion in nature.

Investing in these alternative accommodations can diversify your portfolio and attract niche markets.

2. Prioritizing Sustainability and Energy Efficiency

Sustainability is no longer optional; it’s a key differentiator in the vacation rental market.

Energy-Efficient Appliances: Reducing energy consumption lowers operational costs and appeals to eco-conscious guests.

Renewable Energy Sources: Implementing solar panels or other renewable energy solutions can enhance property value and sustainability credentials.

Water Conservation Measures: Installing low-flow fixtures and sustainable landscaping conserves water and reduces utility expenses.

Properties that prioritize sustainability not only contribute positively to the environment but also meet the growing demand for eco-friendly accommodations.

3. Navigating Market Dynamics and Regulatory Landscapes

Understanding local market conditions and regulations is crucial for successful investment.

Market Saturation: Some areas, like Galveston, Texas, are experiencing an oversupply of short-term rentals, leading to increased competition and longer listing times.

Regulatory Changes: Municipalities are implementing stricter regulations on short-term rentals, including licensing requirements and occupancy limits.

Emerging Markets: Identifying and investing in less saturated markets with favorable regulations can offer better returns and growth potential.

Staying informed about market trends and regulatory developments is essential for mitigating risks and maximizing investment returns.

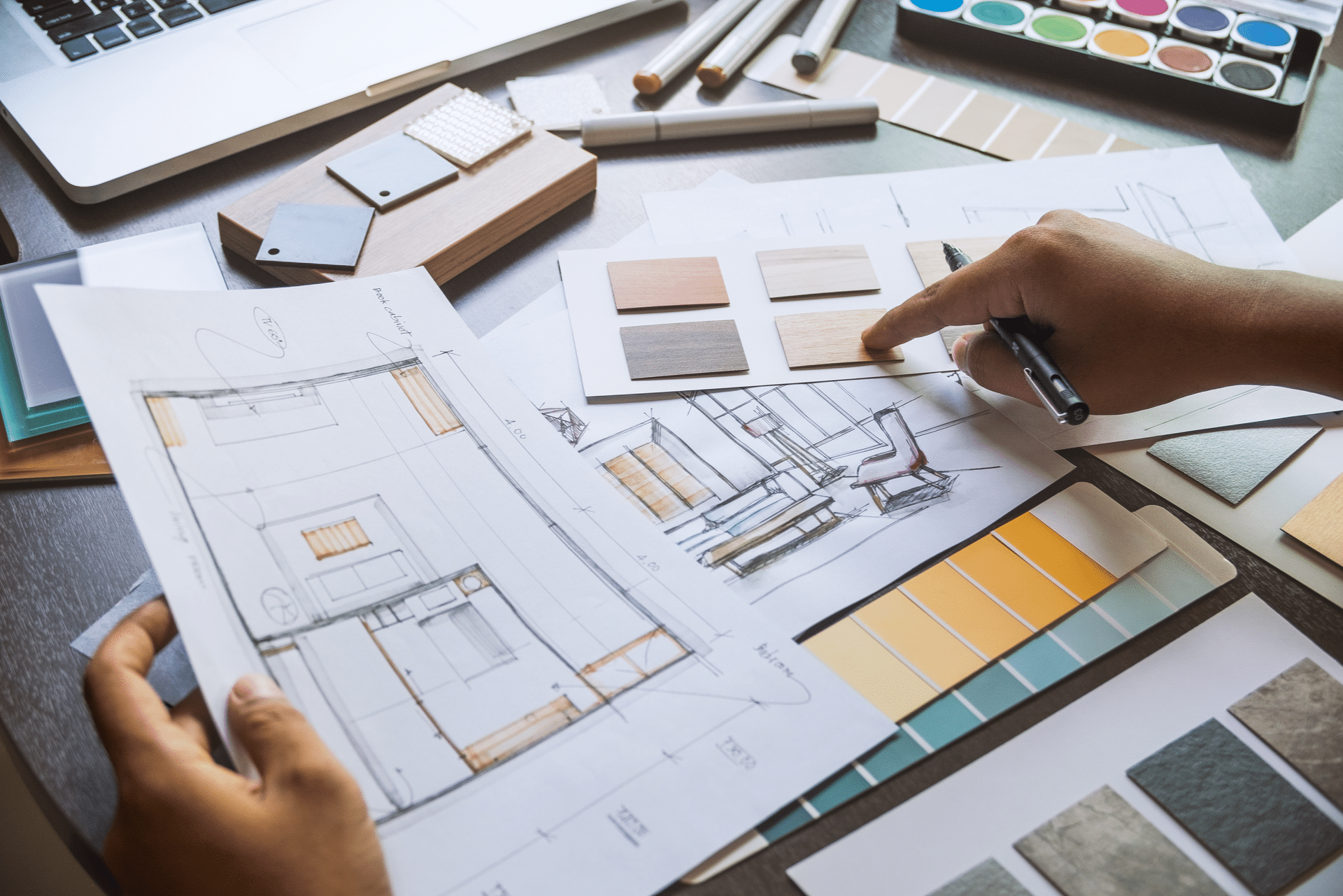

4. Leveraging Technology and Data Analytics

Incorporating technology into property management enhances efficiency and guest satisfaction.

Smart Home Devices: Implementing smart locks, thermostats, and security systems improves convenience and safety.

Property Management Software: Utilizing software solutions streamlines operations, from booking management to housekeeping schedules.

Data Analytics: Analyzing market data and guest feedback informs pricing strategies and marketing efforts.

Embracing technology enables investors to optimize operations and stay competitive in the evolving vacation rental landscape.

Investing in vacation rentals in 2025 requires adaptability and strategic planning. By embracing alternative accommodations, prioritizing sustainability, understanding market dynamics, and leveraging technology, investors can navigate the complexities of the current market and position themselves for long-term success.