Investing in your first short-term rental (STR) in South Florida can feel like a golden opportunity. But many new hosts learn the hard way that beautiful listings don’t guarantee profit. Avoid common pitfalls—from overprojecting returns to compliance missteps—and you’ll save yourself time, cash, and stress.

In this guide, we’ll cover the most common rookie mistakes backed by local data and practical examples. You’ll get actionable advice on budgeting, regulations, listing strategy, insurance, and choosing the right management. Consider it your preventative playbook to start smart and stay profitable.

1. Financial Planning Mistakes

🏦 Overestimating Income and Underestimating Expenses

Relying solely on peak-season rates while overlooking costs like turnover, utilities, taxes, and management fees can derail profit projections. Average STR occupancy in South Florida is now around 47–50%, not the 70%+ often advertised. Research actual local occupancy and integrate realistic startup and operating costs into your pro forma.

📉 Ignoring Seasonality

South Florida peaks in winter and slows in summer. Failing to model low-season rates or vacancies leads to cash-flow gaps. Build conservative scenarios into your pricing plan.

❤️ Buying on Emotion

A dream property doesn’t always deliver returns. Buying based on location or aesthetics, without rental data to back it, often results in underperformance. Vet the investment rigorously.

💵 Skipping Startup Costs

Professional photos, furnishings, security deposits, and licensing fees add up—often unnoticed. Budget for all setup expenses and maintain a reserve of 3–6 months operating capital.

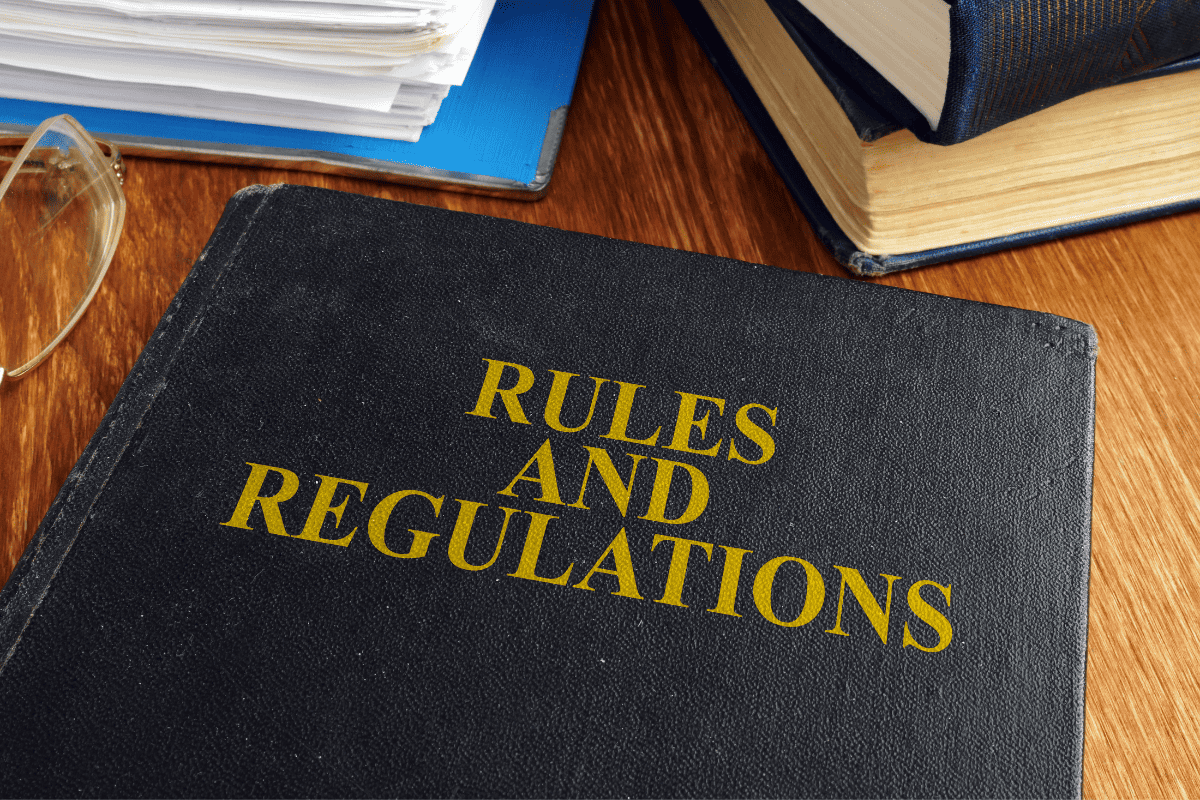

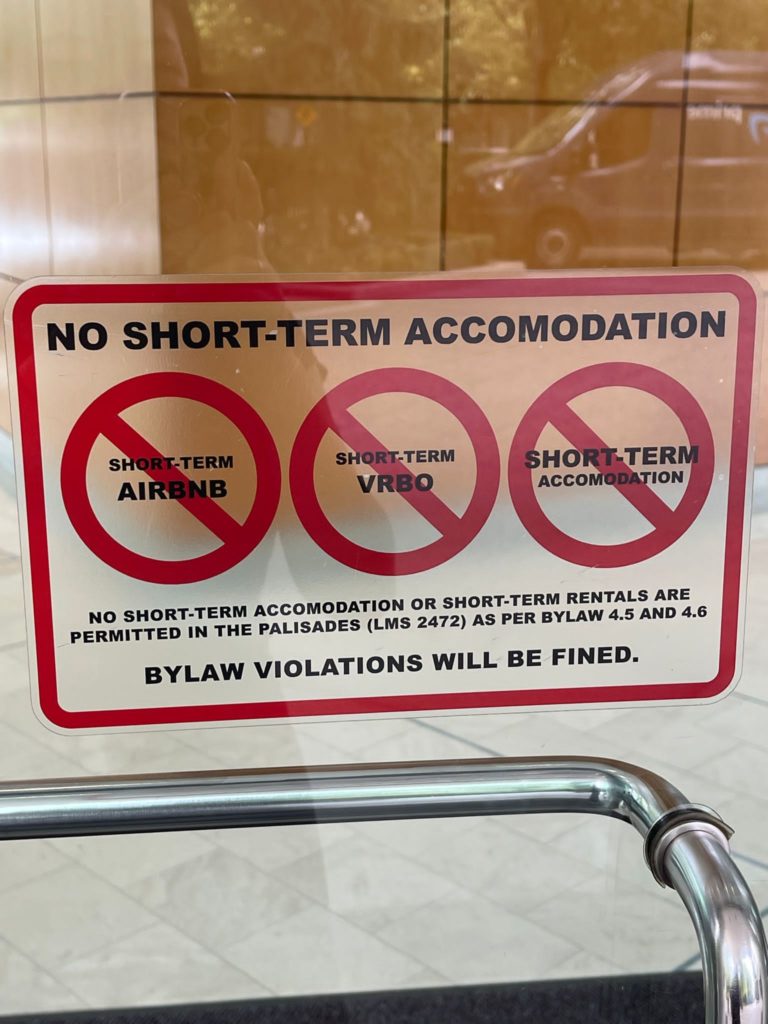

2. Operational and Legal Oversights

⚖️ Ignoring Local Rules and Zoning

South Florida’s STR regulations vary widely—and violations can lead to thousand-dollar fines or forced shutdowns. Some cities enforce fees of $500–1,000 per day for unlicensed rentals. Always verify zoning and licensing before purchase.

🧱 Overlooking HOA or Condo Rules

Attractive condo buildings may impose rental minimums or outright STR bans. If you ignore that clause in your HOA covenant, you risk being blocked from renting altogether. Get the property documentation—before you buy.

🛡️ Skipping Proper Licensing or Insurance

Florida requires a state DBPR permit and tourist tax registration for STRs. Guest-related damage is typically not covered by a homeowner policy. Guest injuries, hurricanes, floods, and lost income require specialized STR insurance.

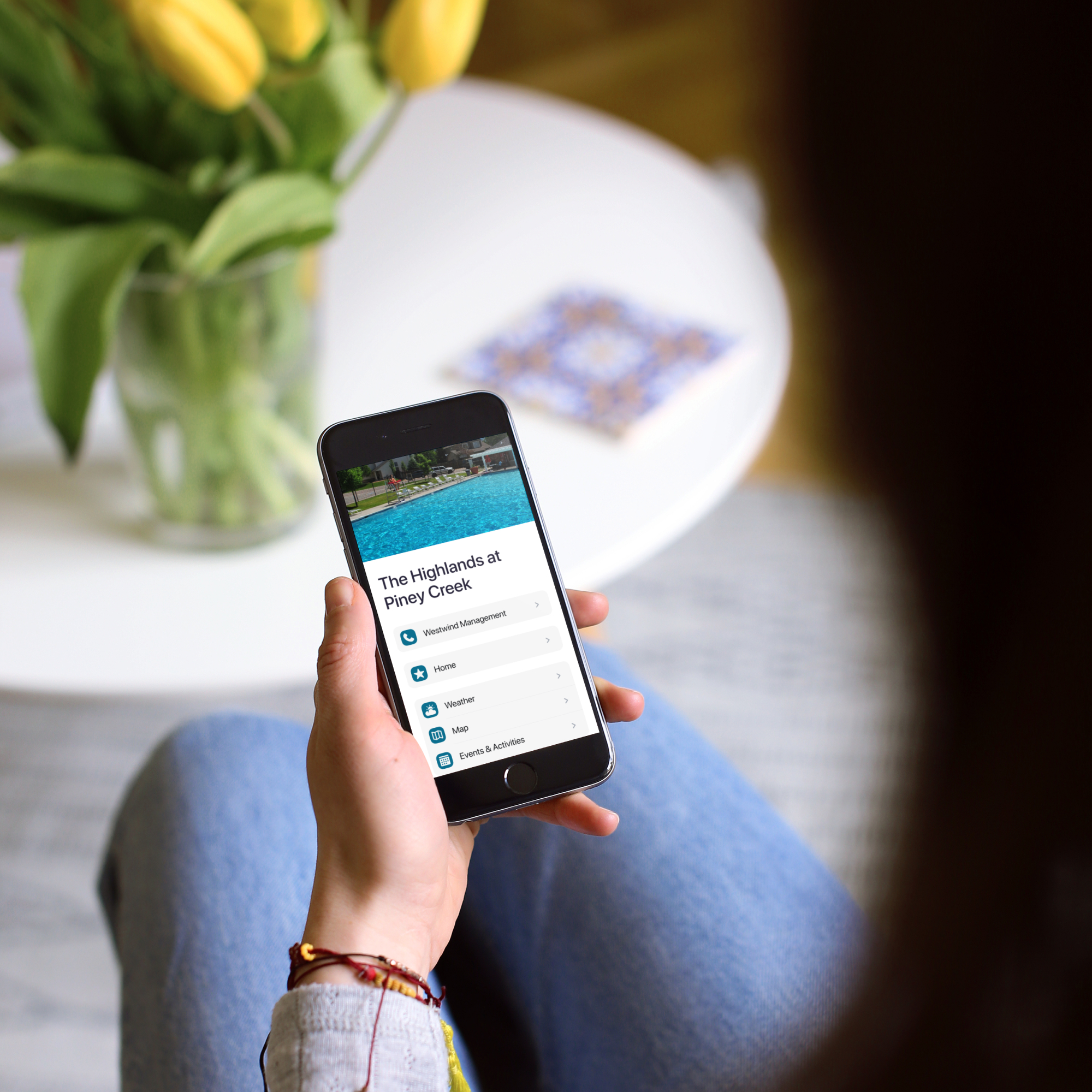

🧑💼 Mishandling Management Strategy

DIY management can lead to burnout—especially during busy season or emergencies. Hiring a property manager typically costs 20–30% of revenue. Interview multiple providers, compare services, and choose one aligned with your strategy.

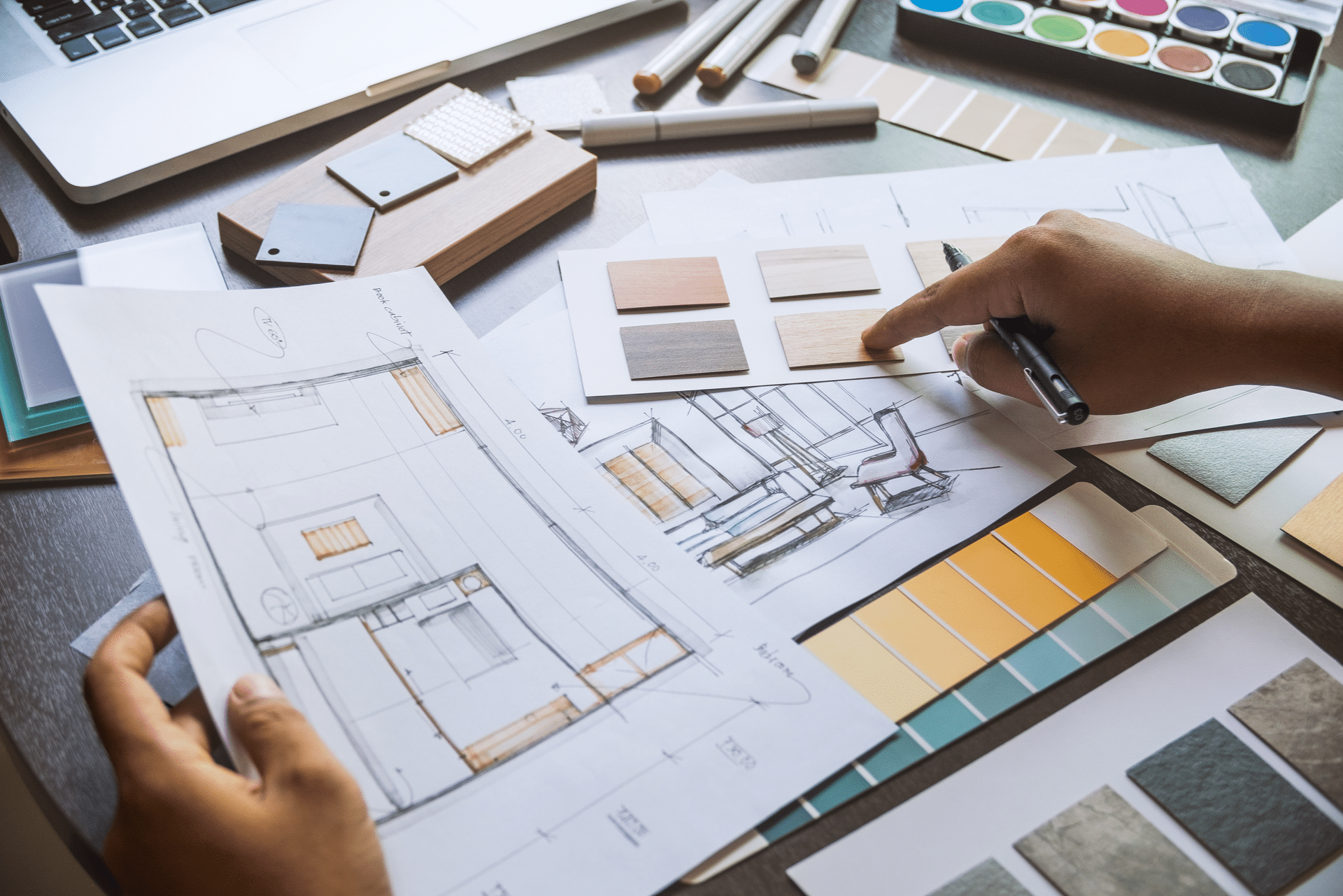

3. Listing & Guest Experience Mistakes

📸 Poor Photos or Listings

Subpar visuals and vague descriptions result in fewer bookings. Listings with quality imagery, accurate descriptions, and thoughtful detail perform significantly better. Don’t rely on DIY photos—invest in a pro shoot.

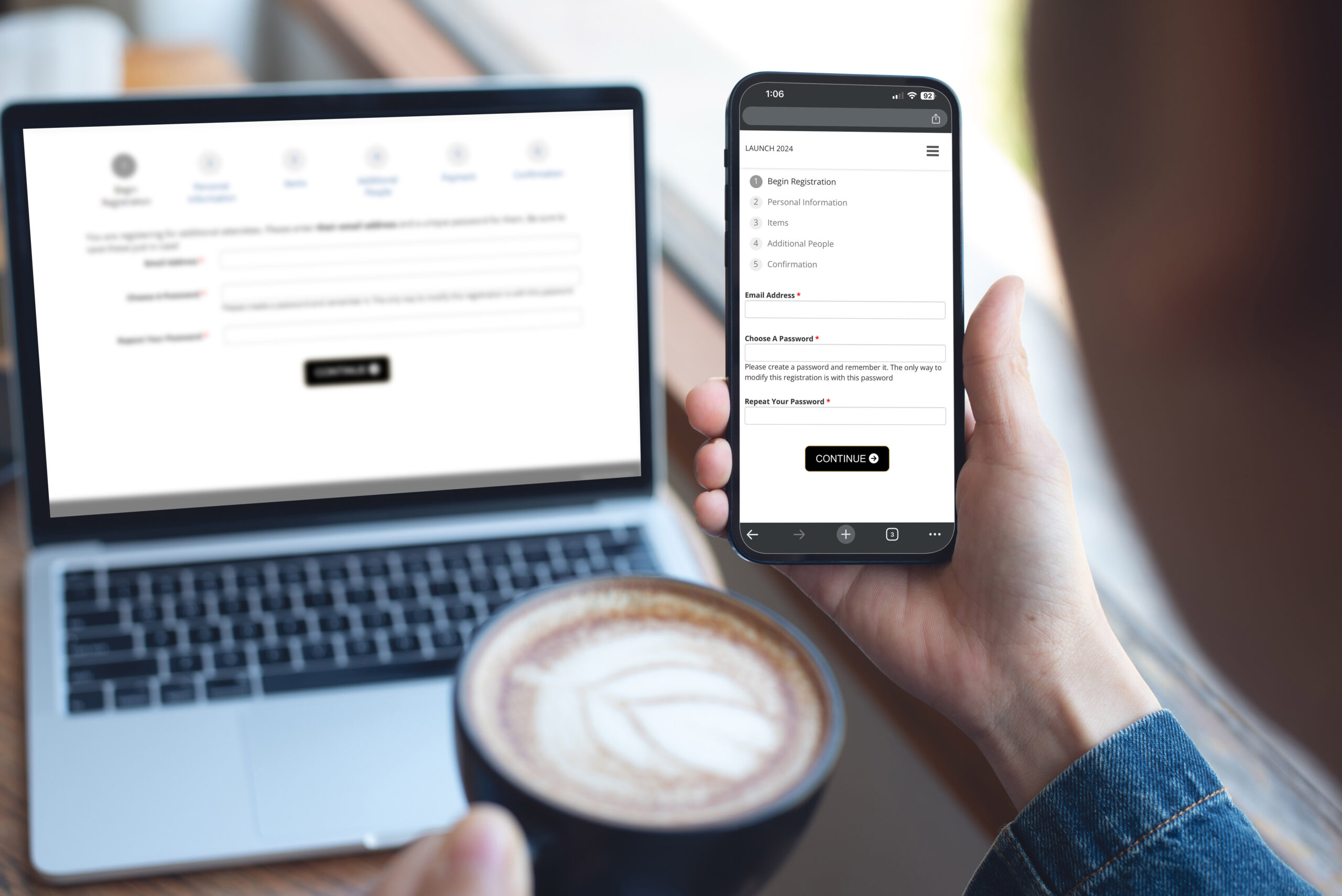

📨 Mismanaging Guest Communication

Prompt responses and clear instructions reduce cancellations and boost reviews. Platforms reward fast responders. Ensure check-in logistics and house rules are crystal clear to avoid miscommunication.

📊 Ignoring Platform Algorithms

Airbnb and Vrbo favor listings that optimize pricing, maintain strong response rates, and accumulate positive reviews. Use dynamic pricing and multi-platform listing strategies to remain competitive.

4. Risk Management & Exit Planning

🌪️ No Hurricane or Emergency Plan

Ignoring hurricane season is a recipe for disaster. Have a protocol for cancellations, guest safety, and property protection—and check your insurance includes wind, flood, and loss-of-rental coverage.

💸 Lacking Emergency Reserves

Unexpected repairs, vacancies, or insurance premium hikes can throw off cash flow. Maintain a reserve equal to at least three months of expenses. Dedicate 10–20% of income into a contingency fund.

📉 Not Planning an Exit Strategy

STR regulations, market trends, or competition can change your investment equation. Ensure your property is convertible to long-term or mid-term rental if needed. Have a decision roadmap for when to sell, convert, or change strategy.

Avoiding these common pitfalls puts you steps ahead. South Florida’s STR landscape rewards investors who are data-driven, legally compliant, guest-focused, and prepared for volatility. Think of your STR not just as a property, but as a business enterprise—one that demands forecasting, adapted policies, and continuous market vigilance.

With careful research, smart execution, and proper safeguards in place, your first STR investment in Florida can thrive—from day one and for years to come.