In the fast-evolving real estate world of 2025, one question echoes throughout South Florida’s investor circles: Should you go short-term (STR) or long-term (LTR) with your rental property?

With insurance rates rising, local STR restrictions tightening, and tenant expectations evolving, the answer is more nuanced than ever. We’ve done the digging — so you can decide confidently.

What’s the Difference Between STR and LTR?

- Short-Term Rental (STR): Rented by the night or week on platforms like Airbnb or Vrbo. These are furnished properties tailored for travelers or business guests.

- Long-Term Rental (LTR): Leased for 6–12+ months, typically unfurnished. Think traditional tenants and lease agreements.

You might also hear about MTRs — mid-term rentals that cater to 30–90 day stays, growing in popularity thanks to traveling nurses, digital nomads, and contract workers.

STR vs. LTR: Pros, Cons & 2025 Realities

| STR | LTR | |

|---|---|---|

| Revenue Potential | High nightly rates during peak seasons. | Stable monthly income. |

| Vacancy Risk | High — depends on season and tourism. | Low — longer lease terms. |

| Management Demand | High: guest support, turnovers, cleaning. | Lower: set-it-and-forget-it with occasional maintenance. |

| Legal/Insurance | More regulations and rising premiums in Florida. | Easier compliance, lower risk. |

| Flexibility | Block dates for personal use. | Locked leases limit flexibility. |

| Tenant Damage Risk | Higher due to frequent guest turnover. | Lower, more predictable wear and tear. |

2025 Trends Impacting Your Decision

- STR Regulations Are Getting Stricter Many municipalities are limiting STR licenses, implementing stay minimums, and increasing inspections. → If you’re in Miami-Dade, Broward, or coastal zones — check your city rules.

- Insurance Costs Skyrocket (Especially for STRs) In hurricane-prone regions like South Florida, insurance for STRs can cost 30–50% more than LTR equivalents.

- LTRs Are Stable — But Rent Growth is Slowing Florida rent prices are plateauing in many urban hubs. While stable, LTRs aren’t printing cash like they did post-COVID.

- Tourism Is Strong, But Guest Expectations Are Higher STR guests now expect hotel-level amenities, responsive hosts, and curated local experiences.

- Hybrid Models Are Trending Investors are blending both: LTRs in the off-season and STRs during peak months (November to April).

What Works Best in South Florida (Right Now)?

Here’s how the decision stacks up across different property types and locations:

- Beachfront Condos: STRs dominate — if your building and city allow it.

- Downtown Miami/Broward Multifamily: LTRs offer strong ROI with stable tenant demand.

- Luxury Vacation Homes: STRs win, but only if professionally managed.

- Older Single-Family Homes: Favor LTRs to reduce turnover costs.

- New Construction or Built-to-Rent (BTR): Ideal for LTR portfolios or hybrid use.

⚠️ Don’t forget to factor in local licensing, condo association rules, and flood zone premiums when evaluating any model.

How to Decide as an Investor

Ask yourself:

- Do I want more control or more consistency?

- Can I handle (or outsource) the demands of guest hosting?

- Is my area STR-friendly, legally and logistically?

- What’s my tolerance for income fluctuations?

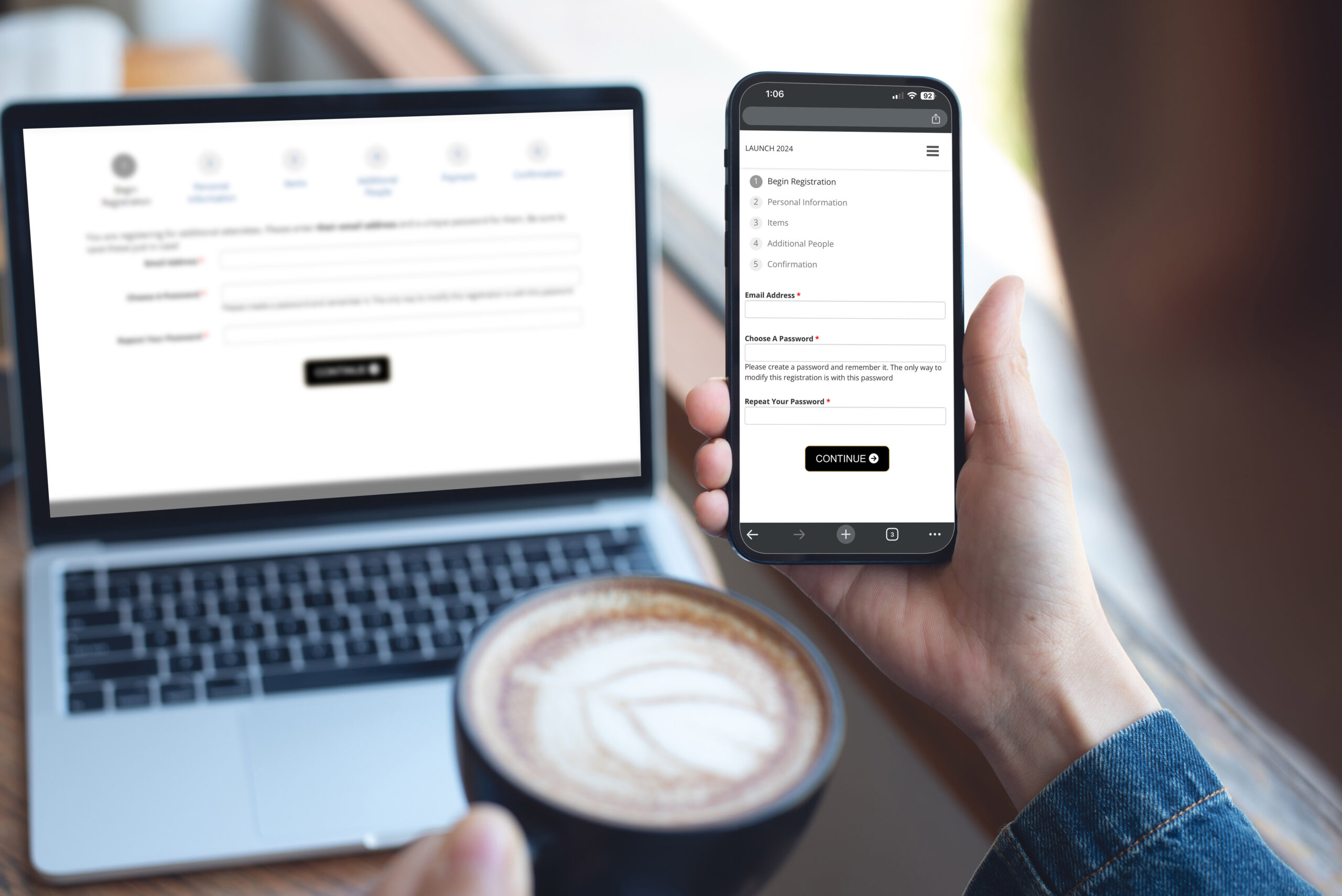

Pro tip: Use tools like BNBCalc, AirDNA, or Mashvisor to compare projected STR vs. LTR income after taxes, cleaning, management, and vacancy.

Our Take for 2025

- If you’re in a high-tourism, regulation-friendly area and willing to manage actively (or hire someone who will), STRs still offer higher upside.

- If you prefer lower risk, predictable cash flow, and fewer headaches, LTRs are a strong play — especially in South Florida’s suburban and mid-range markets.

- And if you’re flexible? A hybrid approach might be your best move yet.

South Florida’s real estate landscape is shifting — and savvy investors know that no one model fits all. STRs still shine for cash-hungry, hands-on hosts. LTRs remain the foundation of stability and long-term growth.

Want the best of both worlds? Mix and match based on season, property type, and local regulations — and let the numbers guide you.

Because in 2025, winning investors aren’t just choosing a model — they’re choosing strategy.