Longer stays are one of the most reliable post-pandemic shifts in vacation rentals. Nearly one-fifth of Airbnb’s booked nights now come from stays of 28 days or more—driven by remote workers, “slomads,” and guests seeking flexible living over quick escapes.

For South Florida investors, the opportunity is clear: this region blends year-round travel demand with seasonal peaks, healthcare and relocation traffic, and (in many cities) friendlier rules once you cross the 30-day line. In many cases, a well-priced monthly rental can earn similar gross revenue as weekly bookings—with less turnover, fewer gaps, and lighter management.

Let’s break down what’s driving the trend, where it’s working best, and how to model your own returns.

1. Market Shift: Why 28+ Nights Are Sticking

Airbnb’s long-stay share hovers near 20% of total nights booked, a number that’s held steady since 2021. Remote work, hybrid offices, and extended relocations have made month-long stays the “third lane” between hotels and traditional leases.

“Slomads” (slow nomads) aren’t the gap-year backpackers of old—they’re working professionals who travel in four- to eight-week increments. U.S. digital nomads now spend an average of 5.7 weeks in each location, and many are choosing domestic destinations over far-flung travel.

Add to that Florida’s recurring post-storm insurance placements and corporate relocations, and you have a dependable layer of mid-term demand that outlasts seasonal tourism spikes.

Investor takeaway: 28–90-night listings smooth out your calendar. They trade a few high-priced weekends for steadier occupancy and lighter operations—often with the same annual gross.

2. The “Slomad” Guest: Who They Are & What They Need

Longer-stay guests fall into a few clear segments:

- Remote pros & couples seeking a warm base for six weeks of work-and-sun.

- Travel nurses and medical staff near Florida’s dense healthcare network.

- Corporate contractors & relocators on short assignments.

- Retirees and snowbirds between homes.

What converts them:

- Strong, reliable Wi-Fi (100 Mbps+) and a real desk setup.

- In-unit laundry, full kitchen, blackout curtains, quiet HVAC.

- Clear parking info, and walkable or transit-accessible locations.

Where they book: Airbnb’s Monthly Stays filter, Furnished Finder (for healthcare pros), Booking.com’s Long Stays, and niche platforms like HouseStay or Blueground. These channels now dedicate sections specifically to 30- to 90-night rentals in South Florida.

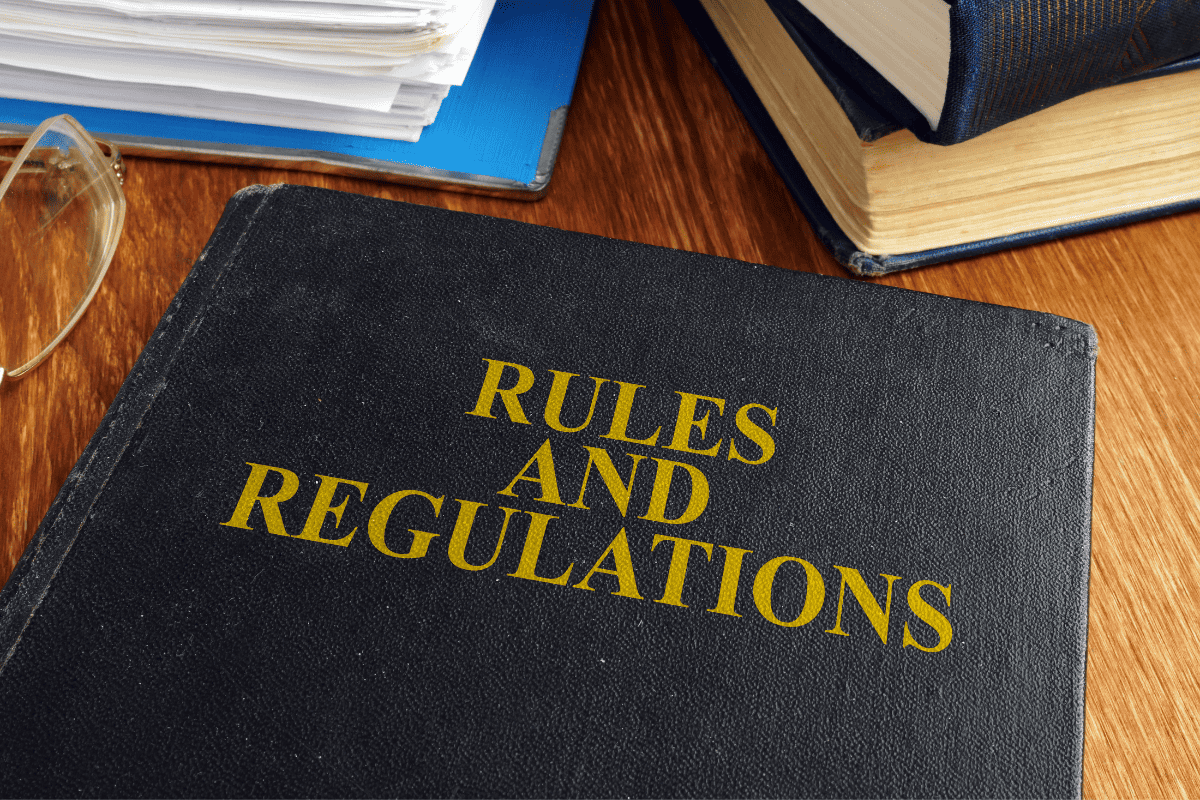

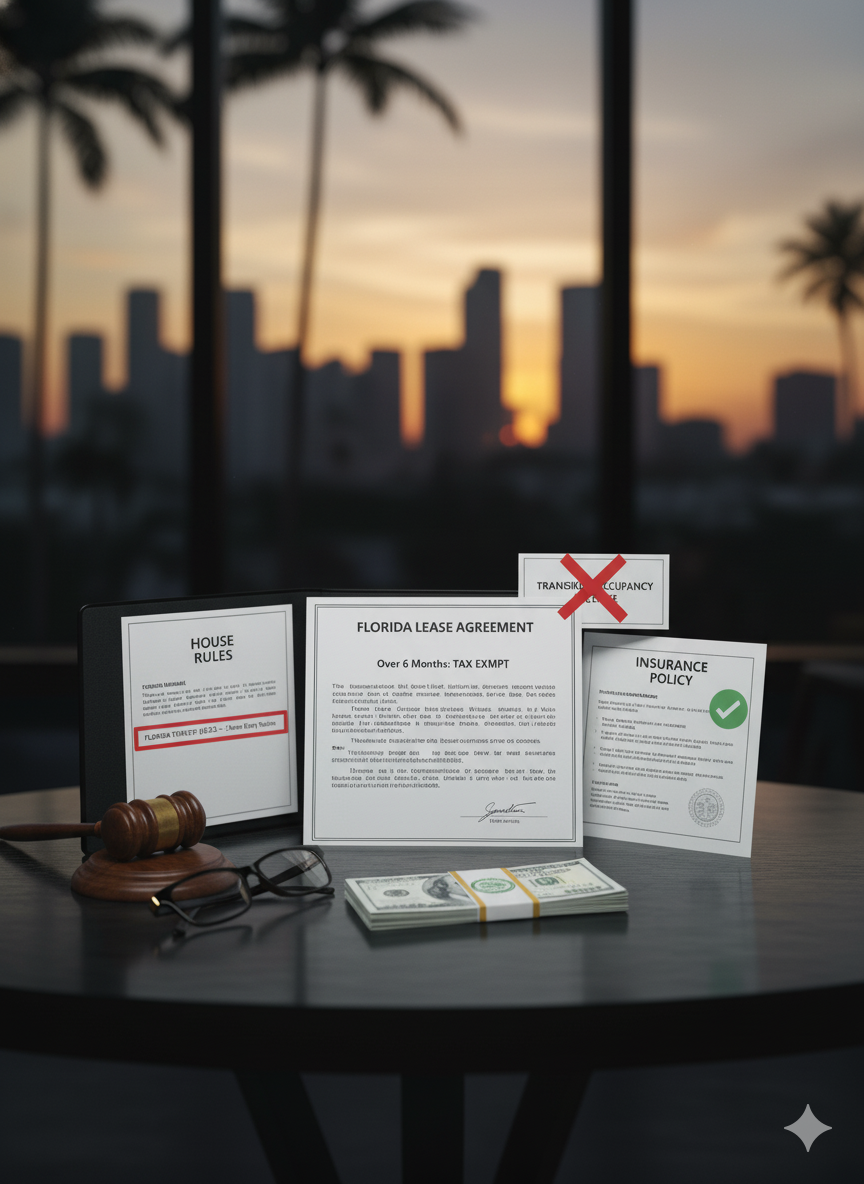

3. Regulatory “Sweet Spots”

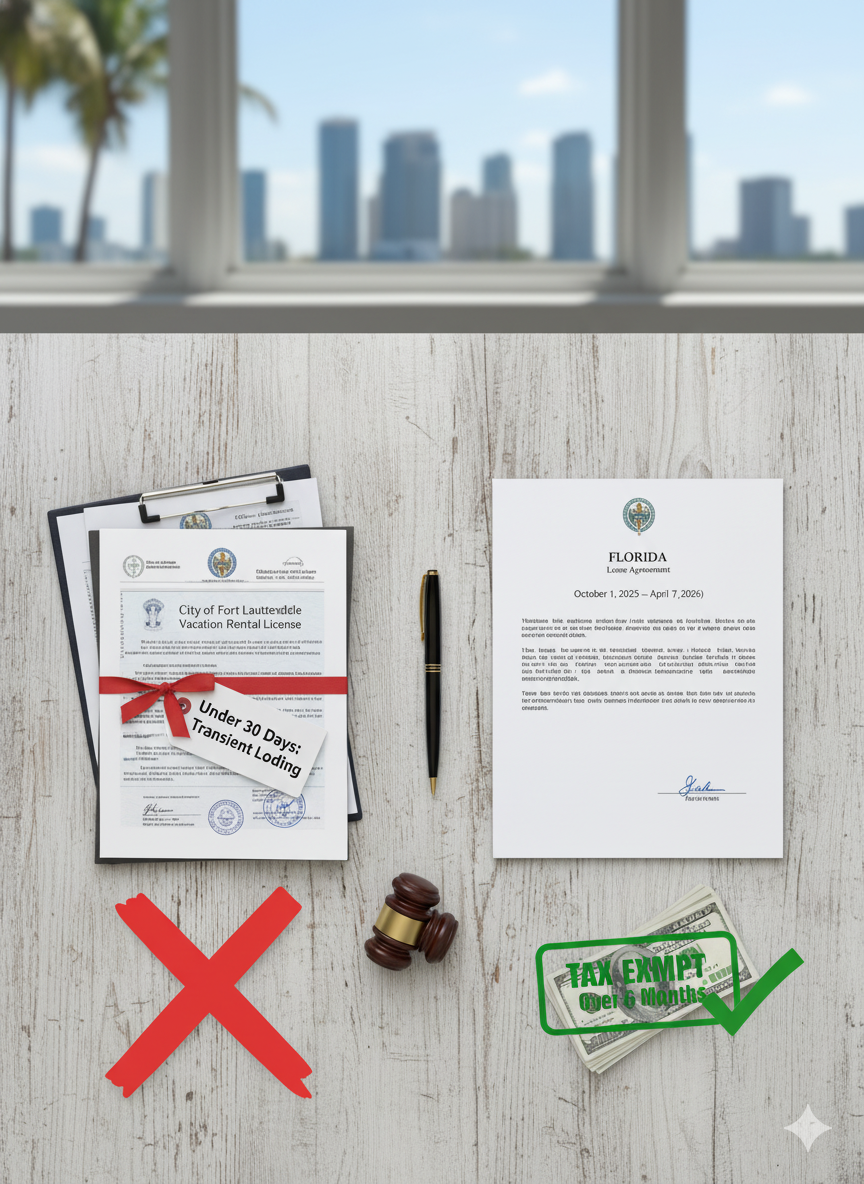

Florida law draws a simple line:

- Under 30 days = transient lodging.

- 30 days or more = non-transient housing.

That shift can move you out of “vacation rental” enforcement in some municipalities—but local overlays still rule the day.

Examples:

- Fort Lauderdale: Vacation-rental license required for ≤30 days. Monthly stays generally exempt (still meet safety codes).

- Hollywood: <30 days = licensed transient use; ≥30 days typically outside that category.

- Miami Beach / Coral Gables: treat anything under six months + 1 day as short-term; not eligible in most residential zones.

- West Palm Beach: city permit still needed, but county tourist tax only applies under 180 days.

Legal note: Confirm with your city, county tax collector, and HOA before assuming 30 days is a safe harbor.

Tax edge: stays over six months + 1 day are generally exempt from Florida sales and tourist-development taxes—provided there’s a written lease and continuous occupancy.

4. Local Demand Signals

You don’t have to guess—public data shows the traction.

- Furnished Finder lists hundreds of 30-day-plus furnished units around Fort Lauderdale’s hospital corridor.

- HouseStay markets West Palm Beach monthly apartments averaging $194–$298 per night for 1-bed units.

- Market baseline: Fort Lauderdale STRs average $195 ADR and ≈ 68% occupancy across all stays.

Those numbers give you a starting point for monthly pricing: maintain near-par gross with far less churn.

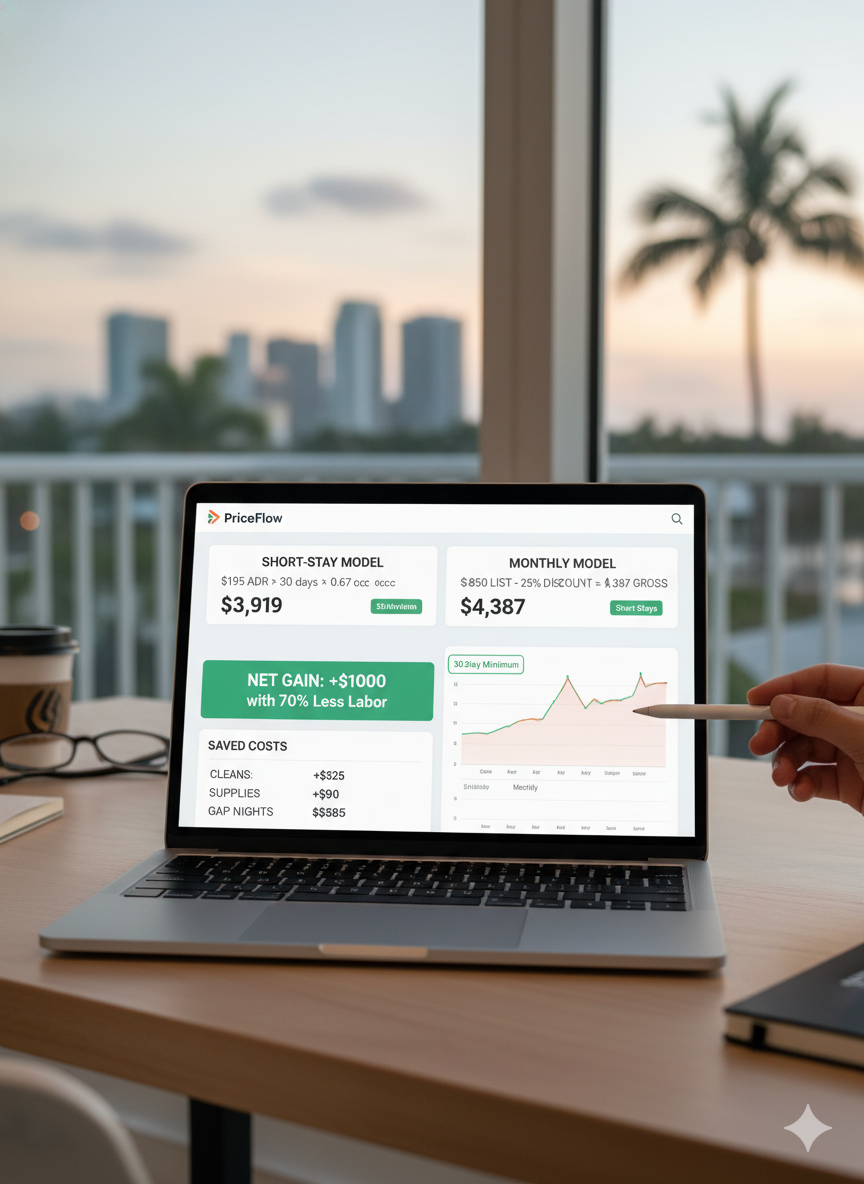

5. Pricing: “Less Turnover, Similar Gross”

Use your short-stay metrics as the base.

Example – Fort Lauderdale 2BR

- Short-stay model: $195 ADR × 30 days × 0.67 occ = $3,919 gross.

- Monthly model: $195 × 30 = $5,850 list. Apply 25% monthly discount → $4,387 gross.

- Saved costs: 3 extra cleans ($175 × 3 = $525) + fewer supply restocks

($90) + no 3 gap nights ($585).

Net: similar or better monthly revenue with 70% less operational lift.

Dynamic-pricing tools like PriceLabs or Wheelhouse now allow Length-of-Stay (LOS) discounts and mid-term rules. Consider a hybrid calendar: 30-day minimums October–April, shorter stays off-season.

6. Setting Up for 1–3 Month Guests

Design your property to feel more livable than leasable:

- Workspace: 27″ monitor, ergonomic chair, surge-protected desk, wired backup internet.

- Storage: dresser + closet space, quality hangers, luggage stand.

- Kitchen: full cookware, sharp knives, storage containers, coffee options.

- Comfort: two full linen sets, blackout shades, mid-weight duvet.

- Maintenance: include a biweekly clean + linen swap baked into the rate.

- House rules: define utility caps, guest limits, mail/package policy, and mid-stay access (Florida §83.53 requires 12 hr notice for entry).

7. Channels & Listing Strategy

Use multi-platform exposure:

- Airbnb Monthly: emphasize “temporary home” tone, workspace specs, and exact Wi-Fi speed.

- Furnished Finder: highlight proximity to hospitals and secure parking.

- Booking.com Long Stays: tap international demand.

- Corporate housing networks: for relocation and insurance leads.

Copy that converts slomads: walk times to coworking, noise-proof HVAC, humidity control, and pet policy transparency.

8. Regional Hotspots

- Miami (Brickell / Health District): corporate + medical demand; heavy zoning limits—verify legality first.

- Fort Lauderdale (Flagler Village / Victoria Park): strong ADRs, airport/convention access, mid-term friendly rules.

- Hollywood / Dania Beach: near FLL + Memorial Health; 30-day stays simplify compliance.

- West Palm Beach: solid healthcare and university demand; confirm permit layer.

- Coral Gables: only 6-month+ seasonal leases legal in most zones—treat as furnished long-term.

9. Paperwork, Taxes & Risk Checks

- Licensing: some cities still count anything under six months as transient.

- Taxes: >6 months = sales/tourist tax exempt (with written lease).

- Tenant rights: 30+-night stays trigger Florida Chapter 83 notice rules—add them to your house manual.

- Insurance: confirm coverage for “non-transient” occupancy.

10. Quick Case Snapshots

- Fort Lauderdale: hundreds of monthly medical listings confirm active 30-day market.

- West Palm Beach: public monthly pricing (~$194–$298 avg night) supports viable slomad ADR bands.

These are open-market data points, not single-host anecdotes—proof that the model transacts today.

11. ROI Mini-Worksheet

| Input | Example (FLL 2BR) |

|---|---|

| ADR | $195 |

| Occupancy (short) | 67% |

| Monthly discount | 25% |

| Cleaning/turn | $175 |

| Turns saved | 3 |

| Gap nights avoided | 3 |

| Supplies saved | $30 × 3 = $90 |

Short-stay gross: $3,919 Monthly gross: $4,387

Add savings (~$700–$800) → potential +10–12% net gain with 75% less labor.

The mid-term wave isn’t a fad—it’s a reshaping of how travelers live and work. For Florida investors, it’s also a hedge: steadier bookings, fewer headaches, and a cleaner compliance lane in markets tightening short-term rules.

Done right, a slomad-ready rental can keep revenue strong while giving you a calmer calendar and happier guests. Think of it as your portfolio’s “set-and-coast” asset—earning quietly while your weekend STRs sprint.

Disclaimer: This article is informational only, not legal or tax advice. Always confirm city, county, and HOA regulations before investing or changing rental terms.