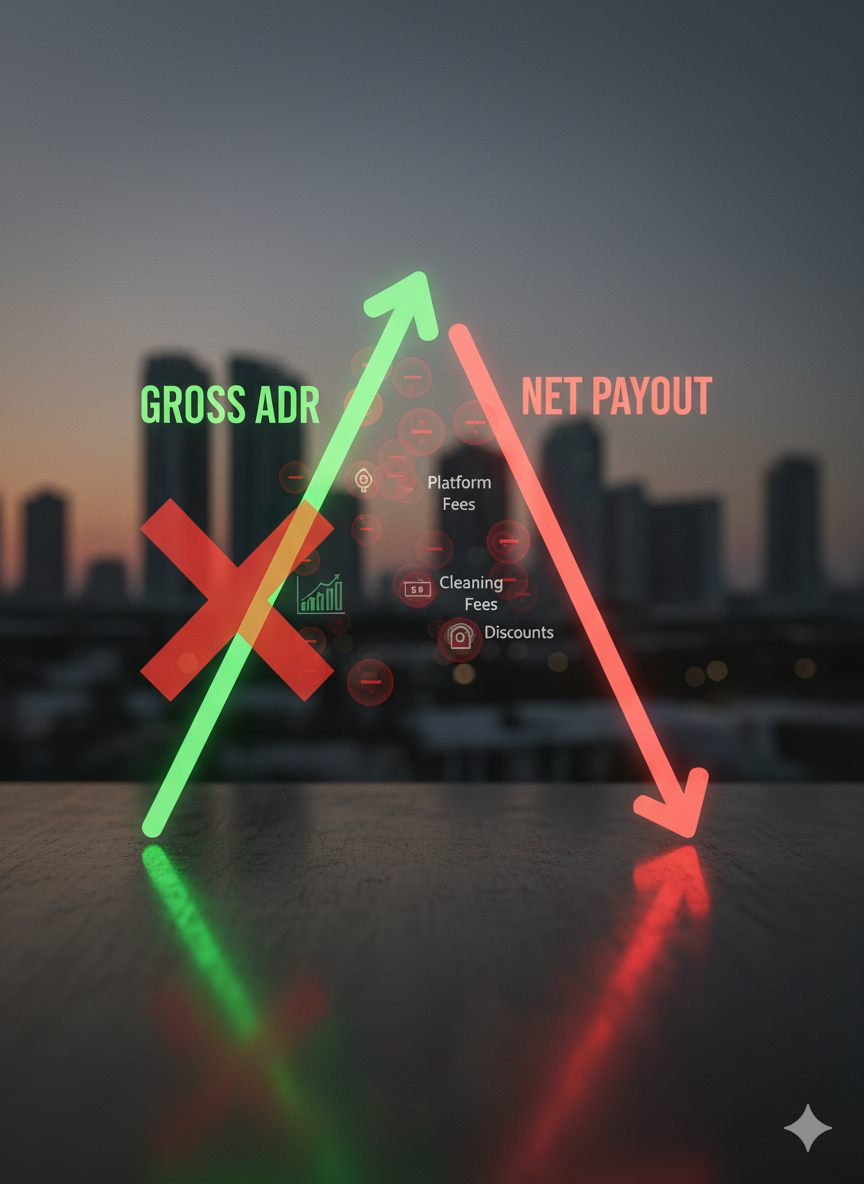

Airbnb’s shift to a host-only service fee didn’t just change how much hosts pay—it fundamentally changed how pricing is experienced by guests. With platform fees now embedded into visible prices and total-price display set as the default, many South Florida operators are discovering a quiet problem: listings that appear to maintain ADR while net payouts erode and conversion softens beneath the surface.

This guide outlines pricing guardrails—not tactical discounts—to help investors and operators protect net revenue, maintain conversion, and underwrite more accurately in a post-fee environment. The focus is South Florida, where submarket dynamics vary sharply between urban cores, coastal leisure zones, and inland suburban inventory.

What Actually Changed—and Why Guardrails Matter Now

As of late 2025, Airbnb standardized its host-only fee model at approximately 15.5% for most hosts, particularly those using PMS or channel-management software. At the same time, Airbnb rolled out global total-price display, meaning guests now see an all-in price (excluding taxes) directly in search results.

This combination created two structural shifts:

- Fee burden moved entirely to hosts, increasing the risk that ADR optics and net payout diverge.

- Guests now anchor decisions on total visible price, making psychological thresholds and submarket elasticity far more influential.

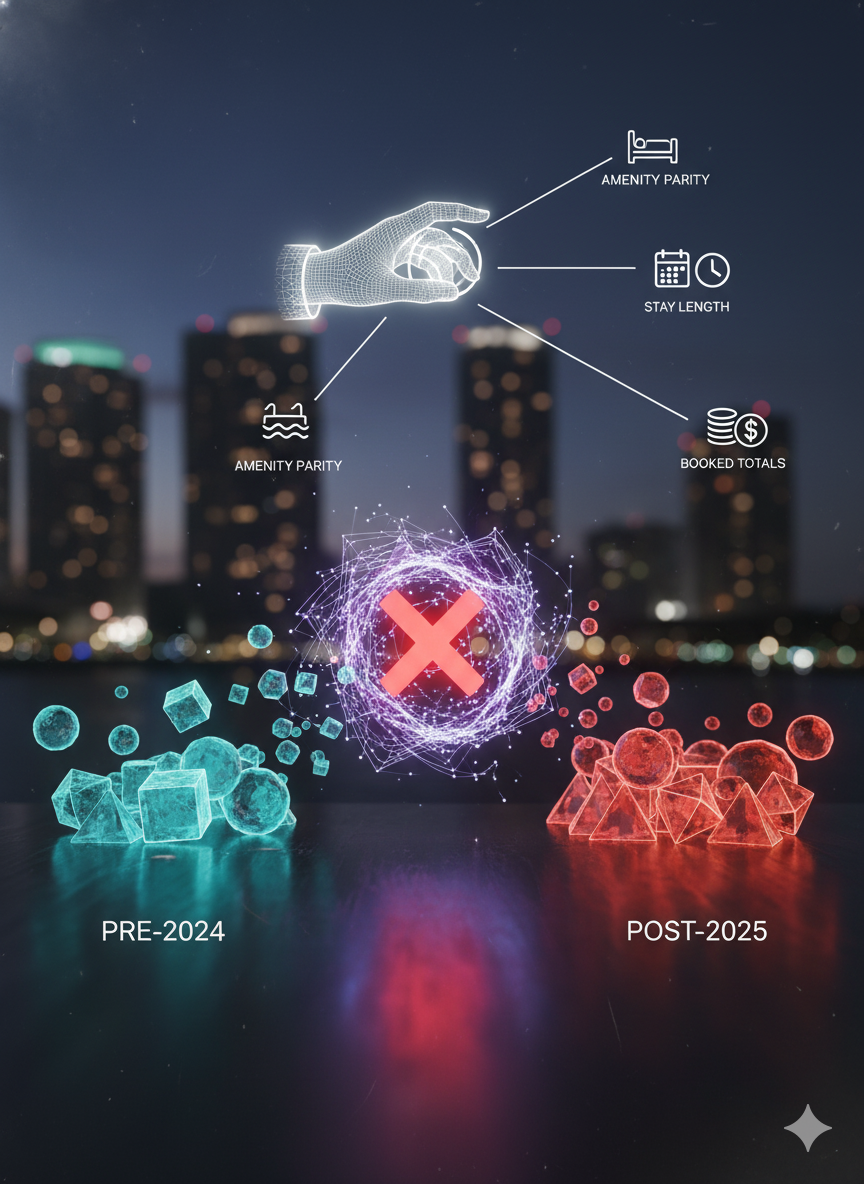

For investors, this means historical ADR benchmarks—especially pre-2025 data—can materially overstate future performance if pricing strategy doesn’t adapt.

Submarket Sensitivity: South Florida Is Not One Market

South Florida’s pricing tolerance varies meaningfully by micro-market. Treating the region as a single pricing environment is now a liability.

High Tolerance – Urban Core & Coastal-Urban

- Miami Beach, South Beach, Brickell, Downtown Miami

- Strong international demand, hotel scarcity, skyline and beach premiums

- Higher visible totals tolerated with less conversion fallout

Medium Tolerance – Coastal Mid-Market

- Fort Lauderdale Beach, Hollywood Beach, Pompano, Lauderdale-by-the-Sea

- Weekend-heavy demand, softer midweek elasticity

- Visible pricing must stay within tighter bands to avoid drop-off

High Elasticity – Suburban & Inland

- Doral, Kendall, Miramar, Pembroke Pines, inland Broward

- Competes directly with hotels on price and convenience

- Visible totals above hotel benchmarks lose conversion rapidly

Actionable takeaway: Pricing ceilings and discount logic must be submarket-specific, not portfolio-wide.

The ADR Illusion: Why Gross Metrics Now Mislead

Under the host-only model, it’s possible—and common—to report flat or rising ADR while net revenue declines.

Why this happens:

- Cleaning fees and short stays inflate visible totals

- Platform fees reduce payouts before variable costs

- Discounting to protect conversion often happens invisibly

Investor-Grade Metrics to Prioritize

- Net ADR (after platform fee)

- Net Revenue per Stay

- Net RevPAR

- Fee Load %

- Effective Take Rate (blended across channels)

Gross ADR without platform context should no longer anchor underwriting or owner reporting.

Portfolio-Level Pricing Guardrails (Not Tactical Discounts)

1. Visible Total Price Ceilings by Submarket & Length of Stay

Rather than chasing nightly rate, set ceilings based on what guests actually see.

Illustrative pre-tax visible-total bands:

High Tolerance (Miami Beach / Brickell)

- 2–3 nights (1BR): ~$999–$1,299

- 5–7 nights: ~$1,999–$3,999 (by size/view)

Medium Tolerance (FLL / Hollywood / Pompano)

- 2–3 nights (1BR): ~$699–$999

- 5–7 nights: ~$1,499–$3,499

High Elasticity (Suburban)

- 2–3 nights: ~$499–$799

- 5–7 nights: ~$999–$1,999

These are starting points, not absolutes, and should be calibrated using local pacing and comp dashboards.

2. Net Revenue Floors (Your Non-Negotiable Line)

Every asset class should carry a minimum Net Rev/Stay floor.

If pricing to protect conversion drops below this floor:

- Increase minimum stay

- Hold rate

- Accept lower occupancy

Do not chase volume that breaks yield.

3. Fee Absorption as a Strategic Budget

Instead of reacting to Airbnb’s fee, define a fee-absorption allowance (e.g., 2–3 margin points) for priority dates or channels.

Recover margin via:

- Lower-take platforms (Vrbo, direct)

- Longer stays

- Reduced discounting beyond thresholds

Track this at the portfolio Effective Take Rate (ETR) level.

Conversion Elasticity by Stay Length

- 1–2 night stays are the most sensitive to visible-price jumps

- Week-long stays tolerate higher totals when space and amenities solve real needs

- Monthly discounts are less persuasive post-reset if they push totals past thresholds

Prefer LOS-specific ladders over blanket percentage discounts.

Competitive Set Drift: Rebuilding Your Benchmarks

Some operators are absorbing more of the fee to preserve optics. Others are passing it through fully. This has shifted competitive anchors.

Guardrail:

Rebuild comp sets monthly, weighted by:

- Amenity parity

- Stay length patterns

- Actual booked totals (not asking rates)

Your true competitors may no longer be who they were in 2024.

Channel Mix as a Margin Lever

With Airbnb at ~15.5% and Vrbo closer to ~8% host take:

- Accept lower Airbnb conversion on select dates

- Steer longer, family-style stays toward lower-take channels

Set a portfolio ETR ceiling (commonly 11–12%) and manage availability accordingly.

Days-Out Guardrails (South Florida Template)

- 45+ days: Hold ceilings, restrict discounts, require longer LOS coastal

- 21–44 days: If pacing lags comps by ~8 points, adjust visible total by 3–5%

- ≤14 days: Use flat-dollar moves to slip under thresholds—not deep % cuts

Discount Psychology Under Total-Price Display

With fee visibility baked in:

- Percentage discounts feel weaker

- Threshold pricing performs better

Best practice:

Aim pricing to land just below familiar totals ($999, $1,499, $1,999) rather than advertising large percentage savings.

Asset-Type Guardrails

- Condos: Hit ceilings faster; pricing discipline is critical

- Single-family homes: Protect yield with LOS rules and amenity clarity

- Luxury: Never break brand or yield floors—value beats discounts

Investor Reporting That Reflects Reality

Shift owner and board reporting toward:

- Net ADR

- Net Rev/Stay

- Fee Load %

- Median visible total by LOS

- Booking window compression

- Cancel rate post-reset

De-emphasize occupancy “at any cost.”

When Not to Protect Conversion

If conversion requires:

- Breaking Net Rev/Stay floors

- Increasing damage risk

- Elevating turnover inefficiency

Hold price. Volume is not value.

Airbnb’s fee reset didn’t make pricing harder—it made it less forgiving.

In South Florida, where demand, elasticity, and guest expectations vary block by block, protecting yield now requires explicit guardrails, not reactive repricing.

Operators who anchor decisions to visible totals, net revenue, and submarket behavior will enter 2026 with cleaner underwriting, stronger conversion where it matters, and fewer surprises hiding behind “healthy” ADRs.

Those who don’t will learn—quietly—that gross pricing is no longer the metric that matters.