Florida 2025: A Pivotal Year for Resort-Area Investors

Between rising HOA fees, stricter reserve laws, cooling condo liquidity, and stable-but-high borrowing costs, Florida investors are re-evaluating where their next dollar goes. And one question comes up again and again:

Is a condotel still worth it — or do STRs offer a better return in 2025?

Below is a data-driven comparison to help you decide where the smarter long-term bet lies.

The Market Backdrop: Florida Condos Are Cooling

Florida’s condo market is slowing — and that matters for any condotel investor thinking about liquidity or exit timing.

- Closed sales: –14.2% YoY (Q2 2025)

- Median time to contract: 65 days (up from 48)

- Months’ supply: 10.0 (up from 7.0)

This translates to longer sell times, more price negotiation, and a smaller buyer pool — particularly impactful for condotels, which already face limited financing options.

Meanwhile, half of Florida’s condo stock is 30+ years old, and post-Surfside legislation (SB 4-D, SB 154) is pushing associations toward expensive structural inspections and reserve funding.

The result:

Higher HOA dues, more special assessments, and rising operational costs.

That’s before even factoring in Florida’s insurance environment.

How Condotels Actually Work — and Why Returns Feel Tight

Condotels promise convenience: front desks, housekeeping, hotel branding, and turnkey management. But the trade-offs are real.

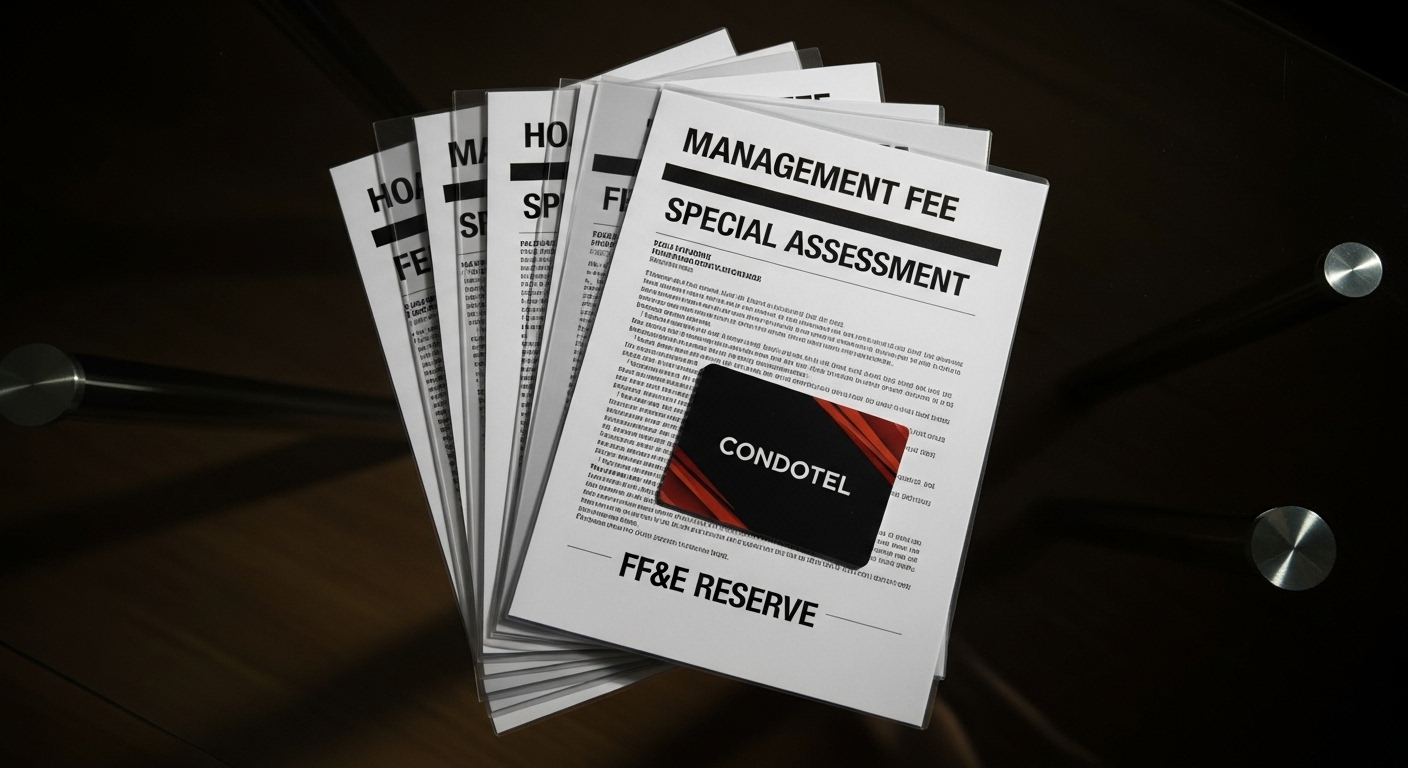

How the money flows:

- ~10% skim “off the top” by the hotel program

- Remaining revenue split ~50/50 between owner and operator

- ~5% FF&E reserve taken from the owner’s share

Owners also face:

- Required furnishing packages

- Brand standards they must maintain

- Rental blackout periods

- Program-set pricing (no dynamic flexibility)

- High resort/HOA fees typical of oceanfront towers

And critically:

Condotels are ineligible for conforming loans.

Fannie Mae classifies them as hotel/motel assets — pushing buyers into portfolio or non-QM loans with 20–30%+ down payments and tighter scrutiny.

This narrows resale liquidity and creates a structural disadvantage compared to STR-suitable properties.

STRs in Flex Zones: More Work, More Yield, More Control

Florida remains a local-control state after the 2024 vacation-rental bill veto. Cities set their own rules — and the clearest, most predictable jurisdictions are thriving.

Examples:

Hollywood, FL

- License required

- Mandatory noise-monitoring device

- Posted quiet hours

- 24/7 local contact

Miami-Dade (unincorporated)

- Certificate of Use

- Local responsible party

- Penalty bond requirement

When rules are clear, operators can systematize compliance. And in stable flex-stay zones, STR investors enjoy:

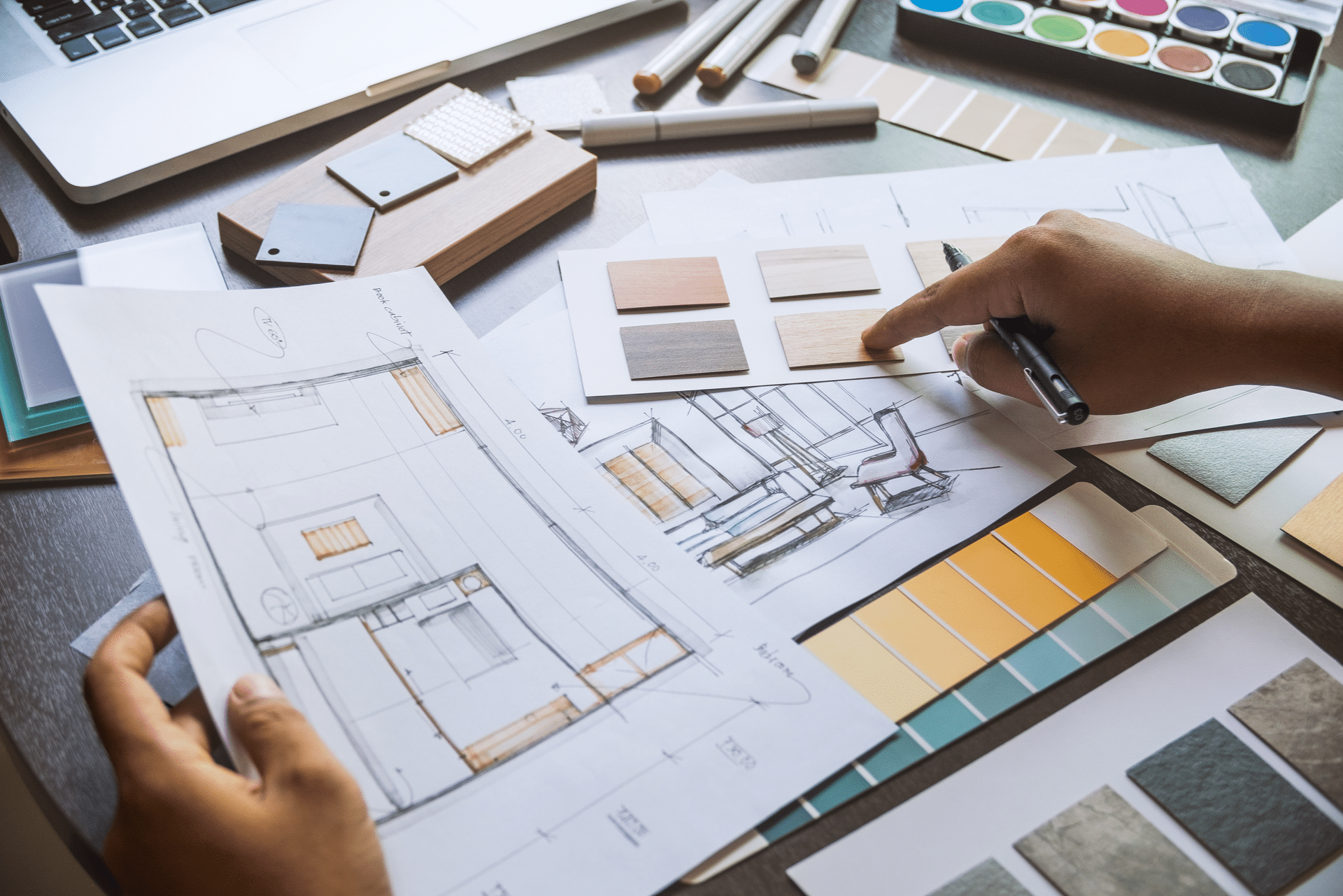

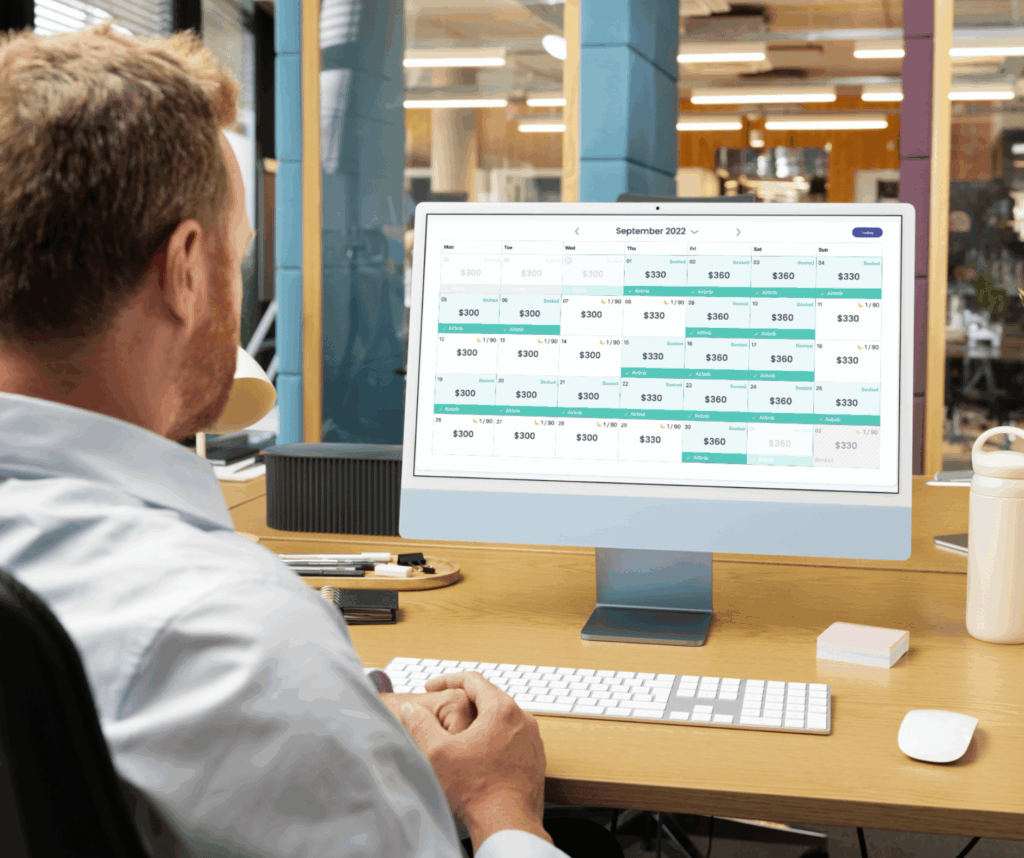

- Dynamic pricing control

- Design control (impacting ADR)

- Amenity control (pet fees, parking, mid-stay cleans)

- Guest-mix diversification including 28–90 night “slomads”

The upside is meaningful — especially now that longer stays account for ~17–18% of Airbnb’s total nights.

Revenue Outlook: Predictable vs. Flexible

Condotels

✔ Stable occupancy

✘ Lower ADR share due to splits

✘ Limited pricing autonomy

✘ Mandatory room refresh contributions

STRs

✔ ADR upside tied to design, location, and dynamic pricing

✔ Direct access to tourism tailwinds (record 33.1M visitors in Q4 2024)

✔ High flexibility during peak season

✔ Ability to pivot to long stays for steadier occupancy

AirDNA’s mid-2025 outlook forecasts a gradual occupancy uptick and muted but positive ADR growth, favoring STR operators with flexible pricing.

Expenses: The Hidden Math Behind NOI

Condotels

Recurring, unavoidable expense layers:

- High HOA/resort fees

- 10% skim + 50/50 revenue split

- 5% FF&E reserve

- Housekeeping charges

- Parking/valet allocations

- Limited control over repairs or CapEx timing

STRs

Flexible but responsibility-heavy expenses:

- Cleaning/turnovers

- PM fees (typically 20–30% in Florida)

- Insurance (up ~34% since 2022)

- Utilities

- Platform fees (Airbnb’s host-only 15.5% path for PMS accounts)

But owners can offset costs by:

- Passing cleaning fees to guests

- Charging pet/parking premiums

- Optimizing ADR around shoulder-season pockets

Legislative & Insurance Realities for 2025

STRs

- Bill veto keeps rules local — city-by-city clarity is key.

- STR regulations trending toward professionalized enforcement, not bans.

- Insurance remains a pressure point but varies by construction type and region.

Condotels & Condos

- SB 4-D & SB 154 push associations into mandatory reserves + structural inspections.

- 2025–2026 are major compliance years — and fees are rising accordingly.

- Older coastal condotel towers face the steepest increases.

Financing & Exit Liquidity: A Critical Split

STR-Friendly Assets

✔ Eligible for conventional loans (if warrantable)

✔ Widespread DSCR and portfolio options

✔ Broader resale audience

✔ Faster absorption than condos in current market conditions

Condotels

✘ No conforming loans

✘ Buyers must go portfolio/non-QM

✘ 20–30%+ down payments

✘ Smaller buyer pool → slower absorption

✘ Constrained resale potential during cooling markets

With Florida condos averaging 65 DOM and 10 months of supply, this matters.

Guest Demand in 2025: Who Books What?

STR Guests Want:

- Full kitchens

- Private outdoor space

- Workspaces

- Laundry

- Multi-bed layouts

Families, remote workers, and long-stayers increasingly choose STRs for these amenities.

Condotel Guests Want:

- Hotel-style service

- Daily cleaning

- On-site amenities

- Prime locations

Both markets have demand — but STRs appeal to growing traveler segments with higher ADR potential.

Risk & Resilience in Florida

Condotels

✔ Hotels reopen faster post-storm → can benefit from relief-worker occupancy

✘ Dependence on tower-wide operations and HOA solvency

STRs

✔ Ability to pivot to mid-term stays during recovery

✔ Faster individual repairs

✘ Higher vulnerability to local regulatory tightening

Insurance remains a statewide structural challenge for both, but older condo/condotel towers are hit hardest.

The Math: Who Really Nets More?

Below is the side-by-side annual net assuming the same $50,000 gross revenue.

| Metric | STR (Self-Managed) | STR (20% PM) | Condotel |

|---|---|---|---|

| Platform fee | $1,500 | — | — |

| Management fee | — | $10,000 | $5,000 (10% skim) |

| Owner share after skim/split | — | — | $22,500 |

| FF&E reserve (5%) | — | — | $1,125 |

| Cleaning/turnover | $6,000* | 0–$6,000 | Included/varies |

| Fixed carrying | $8,000 | $8,000 | $12,000 |

| Owner net | $34,500 | $32,000 | $9,375 |

*If cleaning is passed to guests, self-managed STR nets closer to $40,500.

Version B — Upside Case ($75,000 Gross)

- STR (20% PM): $52,000 net

- STR (Self-managed): $56,500 net

- Condotel: $20,062.50 net

Condotels typically deliver 30–50% of STR net on matched gross revenue.

Which Investor Each Option Fits

STRs Are Best For:

- Operators focused on yield

- Owners wanting pricing/design autonomy

- Investors leaning into 28–90 night stays

- Buyers seeking better exit liquidity

Condotels Are Best For:

- Passive investors

- Buyers valuing hotel service and brand consistency

- Those prioritizing “hands-off” operations in prime resort corridors

Our 2025 Verdict: STRs Hold the Clear Edge

Well-located STRs in clear, stable flex-zone markets remain the stronger investment for 2025 — especially those designed for mid-length stays and professional operations.

You gain:

✔ Better NOI per dollar of revenue

✔ More control

✔ Faster resale

✔ Ability to pivot to demand shifts

Condotels still have a place — particularly for truly passive investors who value simplicity over yield — but rising HOA costs, financing barriers, and high fee stacks continue to drag returns.

For most Florida investors in 2025, the smarter bet is a compliant, professionally run STR in a jurisdiction with clear rules and long-stay demand.